The Economic Crime (Transparency and Enforcement) Act 2022 (the “Act“) introduces a new register, the Register of Overseas Entities (“ROE”) to keep track of the UK property owned by overseas entities. The register includes the details of overseas entities and registrable beneficial owners. If the overseas entities fail to register, the property will be frozen. The HM Land Registry restricts any kind of transaction in relation to the property.

Check Out Our Registration Of Overseas Entities Services!

What is Register of Overseas of Entities (ROE)?

The register of overseas entities is a new register of overseas companies, trusts and similar entities maintained by the Companies House (UK’s government body with regulatory powers over the companies). Any overseas entities who already own properties in the UK or in the process of buying the properties in the UK are required to be registered at the Companies House.

Sample ROE Letter from the Companies House

1. Under new UK law, you are required to register information about the overseas entity and any beneficial owners.

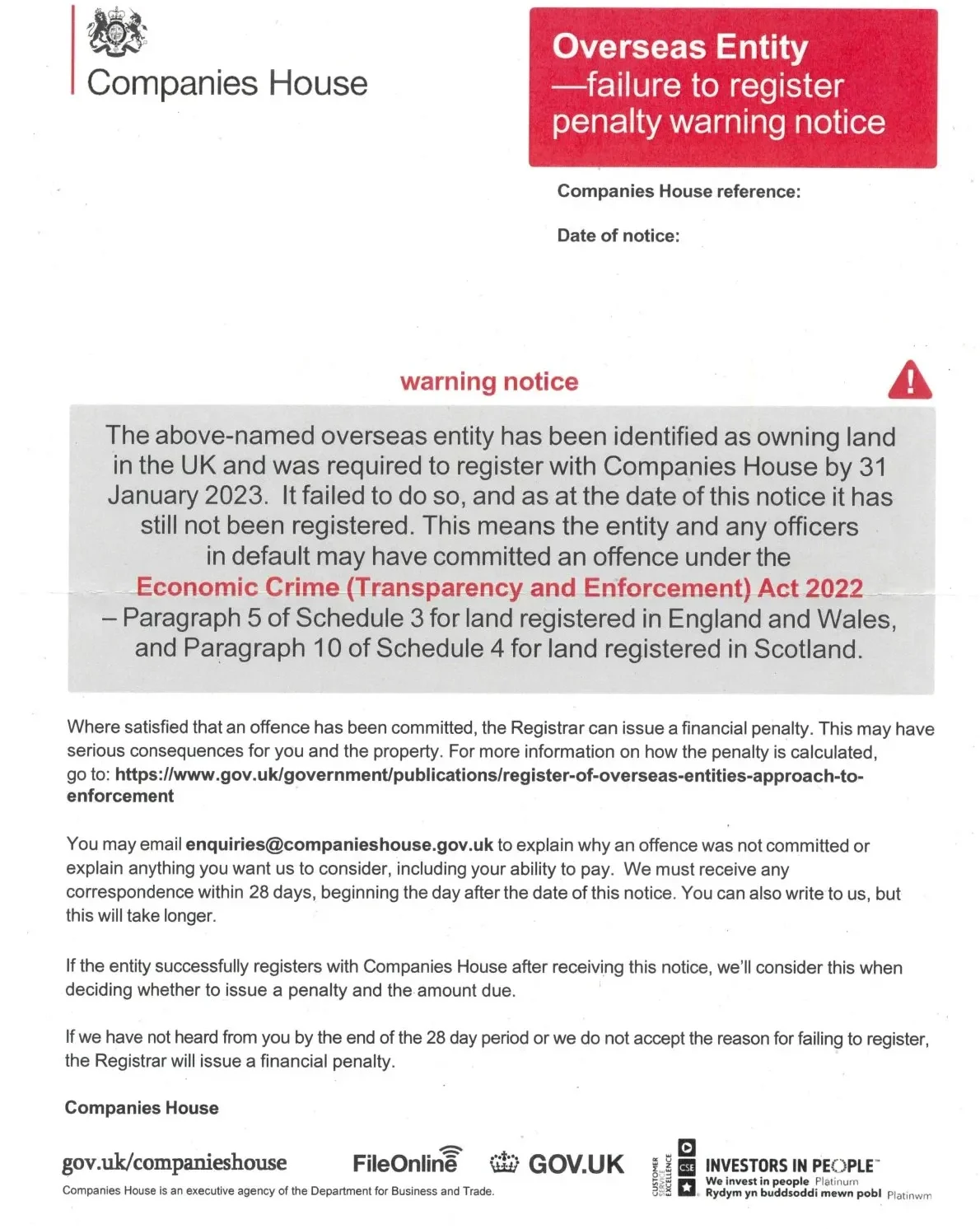

You might receive a letter such as shown below, if you own leasehold or freehold property in the UK but haven’t registered as an Overseas entity. This brings with it a lot of complications as a property owner in the country.

Without a unique ID, an overseas entity may face difficulties owning or transferring properties in the UK. Not to mention, failure to register may also be considered a criminal offense.

In order to create transparency, the details of the overseas entity and its beneficial owners will be available to the public on the online register.

2. Hire a UK-regulated Agent to fly through the ROE Process

To make the process quicker and easier, it is recommended by Companies House to hire a UK-regulated agent.

A regulated agent could be an accountant or legal professional, who is supervised under the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017.

They can help register and file the information on your behalf which tidies up the entire process.

We, at UK property Accountants are equipped with brilliant staffs to navigate you through the registering process.

3. Restrictions instilled by HM Land and Registry: How we can help

Shown below is what the notice of restriction sent to you may look like. It highlights the fact that there are certain boundaries and considerations in place for companies or organizations from outside the country that own land in the UK. And these restrictions may ultimately affect your ability to sell, lease, or mortgage your property.

If you still feel like you aren’t well-versed with the Economic Crime (Transparency and Enforcement) Act 2022 affects you, or are confused the effect of the restriction you should take legal advice.

And since, HM Land Registry doesn’t give legal advice regarding the registration, it’s fair to feel a little overwhelmed. However, our firm is right on board with you every step of the way.

Feel free to contact UK Property Accountants where qualified and experienced company secretaries will swiftly and safely direct you through register of overseas entities process.

Purpose of ROE Regime

There has been long standing concern about the lack of transparency in the ownership of properties in the UK held using overseas vehicles such as offshore companies. This matter came under further scrutiny after high profile leaks via WikiLeaks and similar platforms and recent sanctions on Russians after Ukraine’s invasion.

The UK Government has been working since long to bring much needed transparency in the UK Companies and ownership of UK companies and properties. After successful implementation of personal significant control (PSC) rules for UK companies, the government was continuously looking for new areas to bring much needed transparency.

UK Real Estate market which has significant foreign ownership was obvious target. The government expects the new ROE regime will bring significant transparency in the ownership of the UK properties. This is expected to act as a deterrent for investment of illegal, illicit and controversial money in the UK real estate.

A Tax Compliance Guide | Overseas Entities Owning UK Property

Unlock Overseas Entity Tax Compliance Insights : Navigate with Our Tax Compliance Comprehensive Guide for Fair UK Property Taxation

Types of Entities Required to Register with the Companies House?

All the overseas entities who owns land & properties in the UK and planning to buy land and properties in the UK is required to register with Companies House as Overseas Entities.

The entities here means any entities which is a legal person under the law by which it is established and governed. It includes following types of entities from outside the UK:

- Limited Companies

- Limited Liability Companies (LLC)

- Limited Liability Partnership (LLP)

- Limited Partnership (LP)

- Protected Cell Company (PCC)

- Incorporated Cell Company (IPCC)

- Segregated Portfolio Companies (SPC)

- Variable Capital Companies (VCC)

- Open Ended Fund Company (OFC)

- S Corporation and C Corporation in USA

Is Trust Overseas Entity?

No (generally). The legislation defines an overseas entity as a legal person under the law under which it is governed. Generally, trusts are not registered as a legal person and so not an overseas entities under ROE.

However, if trust is registered as a legal person in your jurisdiction, it may be treated as overseas entity.

Although trust will not generally be an overseas entity, it will be registrable beneficial owners.

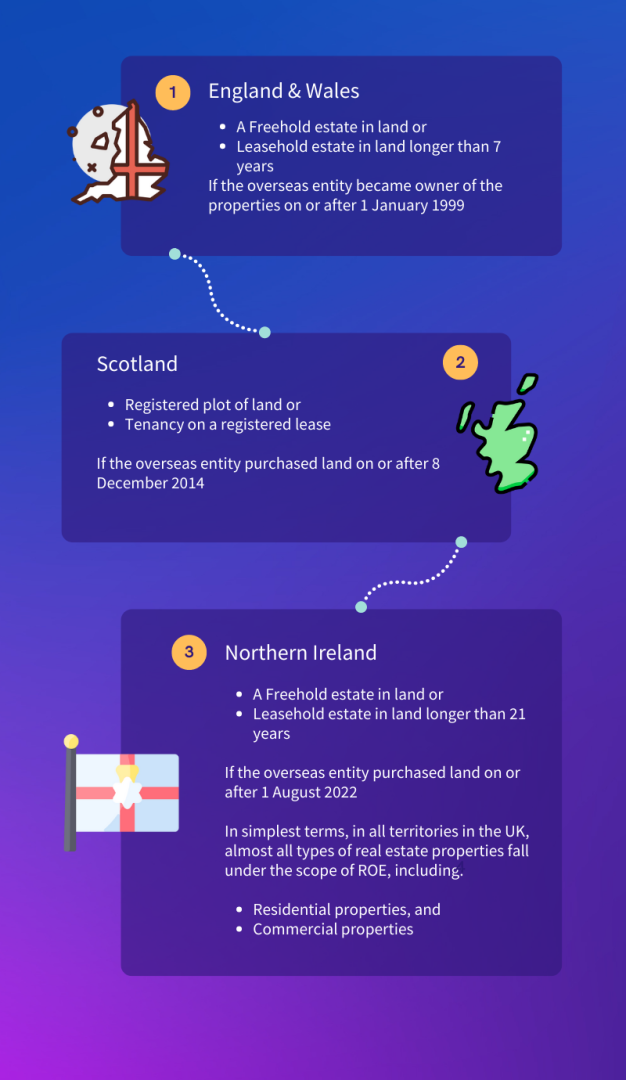

Properties Fall Under the Scope of Register

The properties that fall under the ROE vary depending on the territory in the UK. For instance, in England and Wales, properties that must be registered include freehold estate or Leasehold estate in land longer than 7 years, (on or after 1 January 1999).

This clear and concise chart below provides a quick overview of who is required to register and what kind of overseas entities fall under the ROE.

What is The Deadline for Registration?

When the Companies House introduced this legislation in August 2022, all overseas entities were required to register within 31 Jan 2023.

Overseas entities aiming to engage in property transactions like purchasing, selling, transferring, or placing a charge on their property must be registered in Companies House.

What Happens if Overseas Entities Don’t Register?

All the real estate assets (both freehold & leasehold) located in the UK will be frozen. This means the overseas entity can’t sell or transfer the properties they own in the UK. There is also risk of being treated as criminal offence.

This can be problematic for the overseas entities. As there is substantial work required for the complete verification & registration, we strongly recommend to initial the process on timely basis to avoid any significant issues.

A Complete Guide on Corporation Tax in UK

The UK corporation tax system can be complex, Our comprehensive guide will teach you everything you need to know, from the different rates of corporation tax to the penalties for non-compliance.

Complete Process of Registration of Overseas Entities the UK

1. Identification

The entity identifies and confirms the beneficial ownership information to the UK regulated agent.

UK Regulated Agent Verifies the Information.

UK Regulated Agent fills the application form together with all the relevant information to the Companies House.

The Companies House issues an Overseas Entity ID (OE ID).

The records in the register must be updated annually.

How long Does it Take to Get Overseas Entities Registered at the Companies House?

The main time-consuming component of the process is the identification & verification. Depending upon the availability and quality of information, this process may take few days to few weeks.

After the verification step is complete and application is submitted to the Companies House, the processing time at the time of writing this article is 2-3 working days. But, we expect this to increase once we near the deadline due to the increased applications.

Annual Filing Requirement

The information provided on the Companies House must be updated annually. Even if there is no changes, the overseas entities need to confirm that the existing registration remains accurate. Such updated information needs to be verified with the same process as the original verification during the registration.

Although compulsory filing requirement is annual basis, the overseas entity can voluntarily elect to update the register prior to the annual filing date.

Stay Compliant With The Register Of Overseas Entities With Our Annual Update Service

Identification of Registrable Beneficial Owners

The law mandates overseas entities to identify the registrable beneficial owners. The registrable beneficial owner may be:

An Individual

A legal entity such as company

A government or public authority

Trustee of Trust

A Member of a firm that is not legal person (e.g. partner in partnership)

The registrable beneficial owners are people who have significant influence or control over the overseas entity. A person can be a beneficial owner if one of the following conditions is met:

-

Directly or indirectly holds more than 25% of the shares;

-

Directly or indirectly exercises more than 25% of the voting rights;

-

Directly or indirectly, is able to appoint or remove a majority of the entity’s board of directors;

-

Have the right to, or actually exercise, significant influence or control over the entity;

-

Are trustees of a trust, members of a partnership, unincorporated association, or other entity that fulfil one or more of the conditions above;

-

Where a person has the right to exercise, or actually exercises, significant influence or control over the activities of that trust or entity.

Note: If one or more of the above conditions are met, disclosure under these provisions will need to be made unless the beneficial owner is a legal entity that has its own disclosure requirements, or an exemption applies.

Information to be Delivered

Please note that this table is made in reference to the details provided by the Companies House.

- Name

-

The country it was formed in

-

Registered office address and correspondence address

-

Public register it appears on and its registration number (if it has one)

-

The deed or title number of the land or property

-

Details of any additional beneficial owners or managing officers at the time the land or property was disposed of

-

Email address – we’ll use this to send important information, including the Overseas Entity ID

-

Legal form and governing law

-

In the case where the entity has disposed of UK property or land since 28 February 2022, it will also need to tell us:

-

The date that the land or property was disposed of

You’ll need to tell us the agent’s:

-

Name

-

Correspondence address

-

Email address – we’ll use this if we need more information about the verification checks

-

Supervisory body

-

Anti-Money Laundering (AML) number, if you have one

You’ll also need to tell us the name of the person with overall responsibility for verification checks.

If you’re a UK-regulated agent, you’ll also need to tell us:

-

When the verification checks were completed

You’ll need to tell us each beneficial owner’s

-

Full name

-

Date of birth

-

Nationality

-

Correspondence address and home address

-

The date they became a beneficial owner for the overseas entity

-

Nature of control

You’ll also need to tell us:

-

If they’re on the UK Sanctions List

-

If any beneficial owners have their personal information protected at Companies House (or are waiting for the results of an application)

You’ll need to tell us each beneficial owner’s:

-

Name

-

Registered office address and correspondence address

-

Legal form and governing law

-

Public register it appears on and its registration number (if relevant)

-

The date they became a beneficial owner of the overseas entity

-

Nature of control

You’ll also need to tell us if they’re on the UK Sanctions List.

You’ll need to tell us each beneficial owner’s:

-

Name

-

Registered office address and correspondence address

-

Legal form and governing law

-

The date they became a beneficial owner of the overseas entity

-

Nature of control

In case no beneficial owners are identified, overseas entities are required to provide information about the managing officers. The managing officers could be the director, manager, or company secretary of the overseas entity.

|

Managing Officer Information In the case of Individual |

Managing Officer Information In the case of Corporate |

|---|---|

|

Full name (and former names, if relevant) |

Name |

|

Date of birth |

Registered office address and correspondence address |

|

Nationality |

Legal form and governing law |

|

Correspondence address and home address |

Public register it appears on and its registration number (if relevant) |

|

Occupation (this is optional) |

Roles and responsibilities in relation to the entity |

|

Roles and responsibilities in relation to the entity |

—— |

Consequence of Non-compliance

If an overseas entity fails to comply with registration requirement, following are the consequences:

-

Daily fine of £2,500

-

Prison sentence of up to 5 years

-

Inability to buy, sell or transfer property in the UK

The overseas entity failing to register will be issued a penalty warning notice. The overseas entity and the officers will be punishable as per the Economic Crime (Transparency and Enforcement) Act 2022.

This is a sample warning notice issued by Companies House for failure to register overseas entity.

Sample Warning Notice

Implication on Loan Facilities

As long as the registration of overseas entities was carried out within the deadline, generally, there should not be any impact on your existing loan facilities. However, if you fail to register ROE, depending upon the loan covenants and conditions, this may count as breach of the facilities.

Also, for all new lending to overseas entities, we expect lenders to have a condition to get registered in the Companies House and obtain OE ID before releasing the funds. Some overseas lenders may not be aware of this new legislation, but we expect this to be conditions for most of the lenders.

A Complete Guide on Capital Gains Tax

Empower Yourself with Capital Gains Tax Knowledge. Navigate complexities and real-world impact. Dive into our article for comprehensive insights.

Governing Legislation for ROE

The process of registration of Overseas Entities is governed primarily by the following legislation: