After the completion of register of overseas entities process in the Companies House to operate in the UK, it becomes subject to the range of taxes applicable to property ownership.

These taxes must be understood and managed correctly to ensure compliance with UK tax laws and avoid any potential legal issues or financial penalties.

In this article, we will discuss these taxes in detail and provide an overview of what overseas companies need to know to comply with UK tax regulations.

Overview of Property Taxes for Overseas Entities in the UK

The UK tax system imposes several taxes on property ownership, and it is crucial for overseas companies to understand and comply with these requirements to avoid any potential penalties. Some of the taxes applicable for an overseas company owning UK property include:

- Corporation Tax,

- Annual Tax on Enveloped Dwellings (ATED),

- Stamp Duty Land Tax (SDLT),

- Non-Resident Landlord Scheme (NRLS),

- Non-Resident Capital Gains Tax (NRCGT)

Each of these taxes has its unique requirements and regulations that need to be understood and followed to ensure compliance.

Understanding UK Property Taxes for Overseas Entities

The UK property tax system can be complex and challenging for overseas companies to navigate. Understanding the taxes applicable to UK property ownership is crucial for overseas companies to avoid any potential penalties and legal issues.

1. Corporation Tax

Starting from 6th April 2020, non-resident landlord (NRL) companies, including those who invest in UK property through collective investment vehicles, are required to file form CT600 annually as they are now taxed under the UK corporation tax (CT) regime.

Prior to this, the income tax regime mandated NRL companies with a property business in the UK to file a form SA700 during the 2019/20 tax year.

Unlike prior SA700, CT600 has to be filed online. The first form CT600 will cover the period from 6 April 2020 to the end of the accounting period. Corporation tax is payable 9 months and 1 day after the end of an accounting period.

Income tax under SA700 period to 6th April 2020 was charged at 20% which is now changed to 19% (the rate is changing after April 2023.)

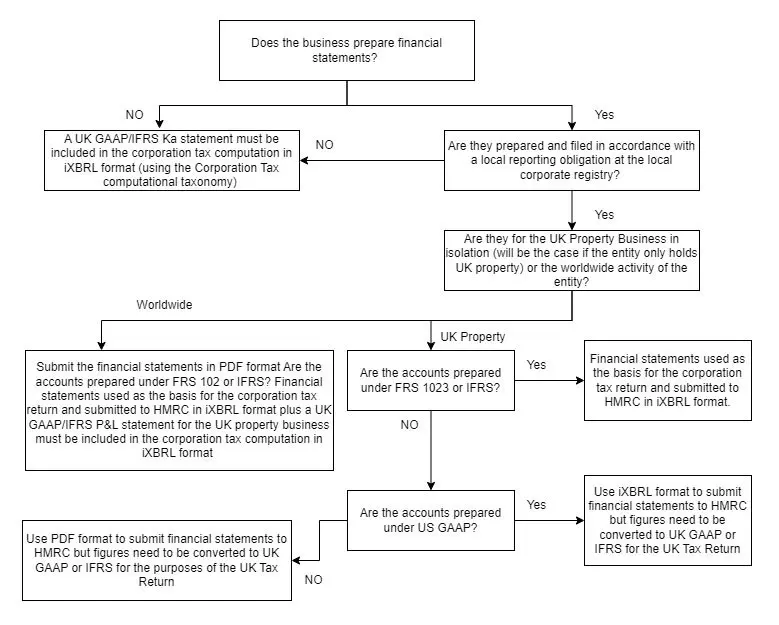

Please refer to our flowchart regarding more detail on how the submission is to be made for an overseas company.

Read our detailed guide to get more information about the Changes in Corporation Tax from April for the year 2023!

2. Annual Tax on Enveloped Dwelling (ATED)

ATED (Annual Tax on Enveloped Dwellings) is an annual tax payable by a company that owns UK residential property.

For an overseas company owning a residential property valued more than £500,000 per property, the ATED return has to be filed in the following dates

|

Property Type |

Time Period for Filing the Return |

|---|---|

|

New Acquisition |

Within 30 days of acquisition, if it comes within the regime after 1st of April. |

|

Newly built property |

Within 90 days of ,

(Whichever is earlier) |

|

Any other case |

30th April |

The ATED annual charges for 1 April 2023 to 31 March 2024 are as follows:

Property Value | Annual Charge |

|---|---|

£500,001 to £1,000,000 | £4,150 |

£1,000,001 to £2,000,000 | £8,450 |

£2,000,001 to £5,000,000 | £28,0650 |

£5,000,001 to £10,000,000 | £67,050 |

£10,000,001 to £20,000,000 | £134,550 |

More than £20,000,000 | £269,450 |

However, relief from the ATED charge may be available under certain circumstances.

For instance, the property must be let to a third party on a commercial basis and not occupied or available for occupation by anyone connected with the owner.

More detail about the relief has been explained below:

- Let to a third party on a commercial basis and is not, at any time, occupied (or available for occupation) by anyone connected with the owner

- Open to the public for at least 28 days a year

- Owned by a property trader as the stock of the business for the sole purpose of resale

- Repossessed by a financial institution as a result of its business of lending money.

- Acquired under a regulated home reversion plan

- Being used by a trading business to provide living accommodation to certain qualifying employees.

- A farmhouse occupied by a farm worker or a former long-serving farm worker.

- Owned by a registered provider of social housing or a qualifying housing co-operative.

3. Non Resident Capital Gain

The capital gain on the sale of the property is taxed at the corporation tax rate of 19%. However, this rate will change April 2023 onwards.

To determine your non-resident capital gains, you can subtract specific expenses from the proceeds of your asset disposal.

These expenses include the original cost of acquiring the UK property or land, expenses related to improving the property or land, and any incidental costs incurred during the disposal process.

For UK residential properties owned prior to 6 April 2015 that are directly sold by you, the market value as of 5 April 2015 is generally used in place of the acquisition cost. Only enhancement expenses incurred after 5 April 2015 can be deducted from this adjusted cost basis.

When disposing the UK property after 5 April 2015, the gain is computed after deducting the acquisition cost with all the direct cost associated with the UK property or land with the sale consideration.

The overseas company is not required to file a separate CGT return. This will be reflected in the corporation tax return filed at the end of the accounting year.

Our brief article "Non-Resident CGT (NRCGT) Returns" provides a better insight and reduces the complexities that Non-Resident CGT entails.

Stamp Duty Land Tax (SDLT)

Stamp Duty Land Tax (SDLT) is a tax that is payable on most property purchases in the United Kingdom.

It is a tax on the purchase of land and property, including leasehold properties, over a certain value. The amount of SDLT you need to pay depends on the purchase price of the property and your circumstances.

Starting April 1, 2021, non-UK residents purchasing residential property in England and Northern Ireland will be subject to Stamp Duty Land Tax at varying rates.

The rates applicable to non-UK residents will be 2 percentage points higher than those that apply to UK residents making property purchases. The surcharge will be applicable to purchases of freehold and leasehold properties, in addition to raising the amount of Stamp Duty Land Tax due on rent payments for newly granted leases.

The rate of SDLT will be as follows:

Tax Slab | Basic SDLT Rate (First Property) | SDLT Rate (Additional property) |

|---|---|---|

Up to £250,000 | 2% | 5% |

£250,001 to £925,000 | 7% | 10% |

£925,001 to £1.5 million | 12% | 15% |

Above £1.5 million | 14% | 17% |

The first time buyer relief for an overseas company will be as follows :

Lease Premium or Transfer Value | Rate |

|---|---|

Up to £425,000 | 2% |

£425,000 to £625,000 | 7% |

5. Non-Resident Landlord Scheme

The NRLS, or Non-Resident Landlord Scheme, is designed to levy taxes on rental income generated in the UK by individuals who do not reside in the UK and have a primary place of residence outside of the country. The NRLS places responsibilities on either the tenant or the letting agent (if one is present).

1st April

The 1st April marks the beginning of the new tax year in the United Kingdom according to the NRLS.

31st March

The tax year for NRLS in the UK comes to an end on March 31st of each year.

According to HMRC, non-resident landlords are individuals who generate rental income in the UK and whose primary place of residence is located outside of the country.

In order to ensure that UK income tax is properly paid on UK rental income, the Non-Resident Landlord Scheme (NRLS) was introduced in 1996, imposing strict tax regulations on landlords, tenants, tenant finders, and letting agents. Under Non-Resident Landlord Scheme, a landlord can be companies, trustees, partnerships, etc.

The HMRC Non-Resident Landlord Scheme is employed to oversee the taxation of rental income from UK properties owned by landlords who reside abroad for more than six months of the year, from 1st April to 31st March. Despite the landlord's foreign residency, the UK government taxes the income, even if the rent is deposited into a foreign bank account.

However, due to the potential difficulties for HMRC to collect taxes from overseas residents, the NRLS imposes a legal obligation on either the tenant or letting agent to withhold the tax prior to paying the rent to the landlord. The withheld tax is then remitted to HMRC on a quarterly basis.

Under Non-resident Landlord Scheme, the tenant or the agent is required to withhold the tax at the rate of 20% on the rent paid in the relevant quarter.

A company which has no place of business in the UK and is incorporated outside of the UK can file the form NRL2, if the company wants to apply to get UK rental income paid without deduction of UK tax.

Wrapping it Up

In conclusion, an overseas firm owning UK property is subject to the Non-Resident Landlord Programme, ATED, NRCGT, SDLT & Corporate Tax. These tariffs guarantee overseas companies pay their fair share of UK property taxes.

The ATED taxes high-value residential homes held by corporations, while the Non-Resident Landlord Scheme taxes rental revenue from non-UK residents.

Additionally the NRCGT applies to non-UK residents who sell or dispose of UK property and the SDLT is a tax on the purchase of UK property.