The Economic Crime (Transparency and Enforcement) Act 2022 (the “Act”) introduced a new register, the Register of Overseas Entities (“ROE”) to keep track of the UK property owned by overseas entities.

The primary goal of the registry is to improve transparency concerning the ownership of UK land by foreign entities, encompassing information about overseas entities and their registrable beneficial owners.

The Companies House had previously set a deadline of January 31, 2023, by which all Overseas entities owning property in the United Kingdom must complete their registration within this system.

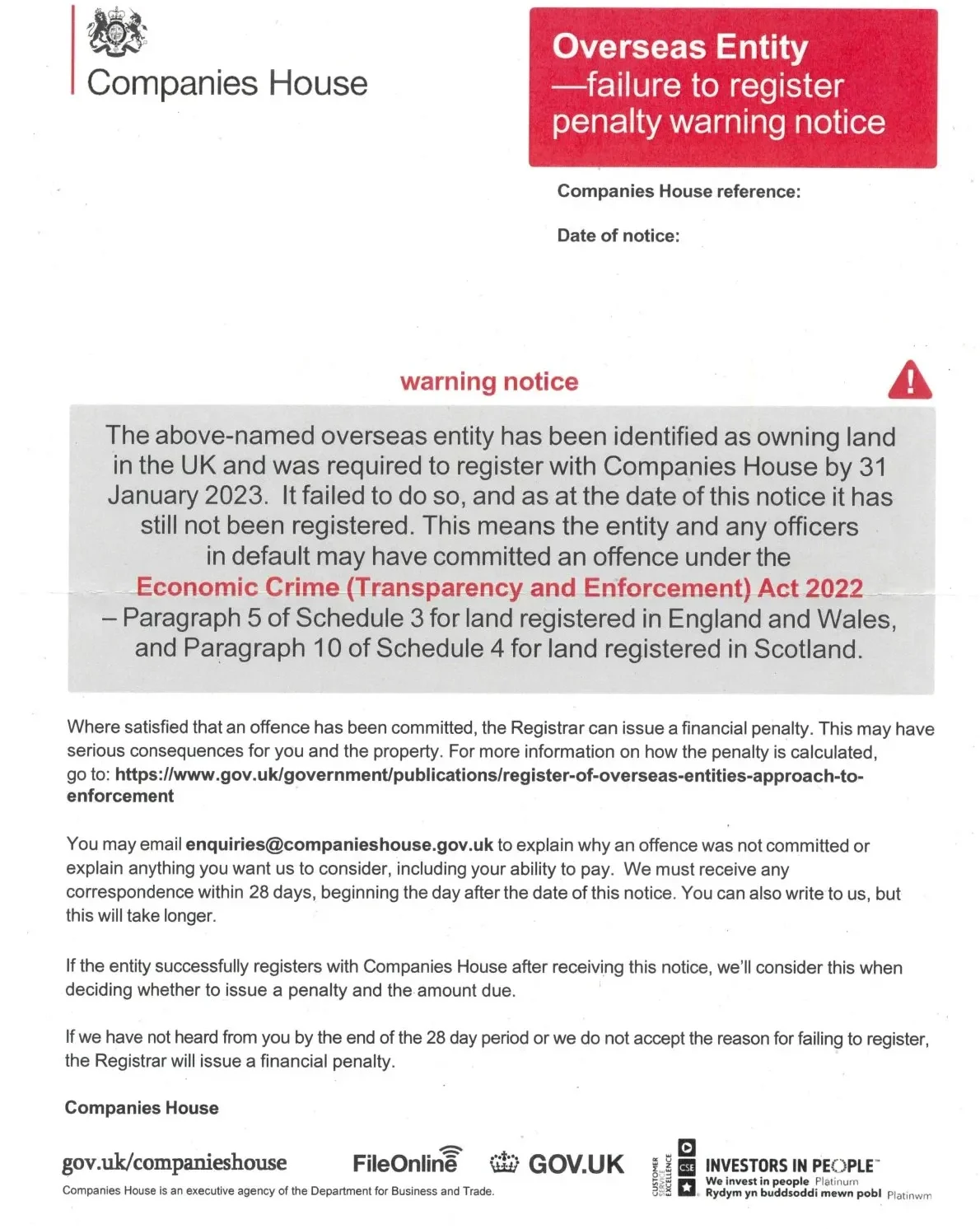

The registry currently consists of over 28,000 entries, but a substantial portion of entities still haven’t completed their registration. Companies House has initiated the issuance of a warning notice, as outlined below.

Sample of penalty warning notice for Overseas Registration

Failure to comply with this notice is an offence. The offence is committed by the overseas entity and every officer of the entity who is in default.

The registrar has started to issue a warning notice when there are suspicions of an offence. The notice specifies the reasons for suspicion, offers individuals a chance to get in touch with Companies House within a defined timeframe, which will be a minimum of 28 days, and warns of the possibility of a penalty being applied if there is no communication within the prescribed period or if the explanation provided is rejected.

Let's explore the potential repercussions that overseas entities may encounter if they do not comply with the requirement to register:

Restrictions on Properties

Entities that have failed to register with Companies House or keep their records updated will be restricted from selling, leasing, or using their properties for collateral. Furthermore, overseas entities won't be able to purchase new property in the UK unless they've completed a valid registration process.

Prosecution of Criminal Activity

Companies House has the authority to forward cases to The Insolvency Service and other law enforcement agencies for potential prosecution, primarily in cases of significant gravity. After such a referral, the prosecuting authority holds full discretion over all decisions related to investigation, charges, and prosecution.

Civil Financial Penalties

The registrar has the authority to impose a civil financial penalty when they are thoroughly convinced that an offense has been committed beyond any reasonable doubt. The nature of this penalty varies based on the type of offense and can take one of three forms: a fixed penalty, a daily rate penalty, or a combination of both.

For example, The Companies House has published a chart of penalty to be imposed for failing to register the entities who have sold their property between 28 Feb 2022 to 31st Jan 2023. The value of each property will be estimated based on data including council tax bands, business rateable value, and the House Price Index.

|

Property Value |

Penalty for Each Property |

|---|---|

|

Low |

£10,000 |

|

Medium |

£20,000 |

|

High |

£50,000 |

As mentioned in the penalty warning notice, “if the entity successfully register with the Companies House after receiving this notice we will consider this when deciding whether to issue a penalty and the amount due”.

The notice indicates that even if the overseas entity registers with the Companies House after receiving the warning, the Companies House may still impose fines. However, they will consider the registration when determining the amount of the penalty.

Also, if an overseas entity does not communicate with the Companies House within 28 days of issue of penalty notice or they do not accept the reason for failure to register, overseas entities will be facing financial penalty.

Therefore, in figuring out the penalty amount, the registrar will also consider any representations made by an entity or individual through email or written communication. This may involve providing details about their financial situation and their capacity to settle the penalty.

Penalty Notice

The penalty notification will detail the grounds for imposing the monetary fine, indicate the type of penalty (fixed, daily, or a combination thereof), specify the penalty sum, offer guidance on the payment process, underscore the requirement to settle the entire penalty within 28 days of notice receipt, clarify the right to appeal, and explain the repercussions if the penalty remains outstanding.

This includes the imposition of interest and the implementation of measures to enforce unpaid penalties. Additionally, the registrar is empowered to adjust or cancel a financial penalty based on individual circumstances.

If a penalty is not paid within 28 days of the date of the penalty notice, the registrar may seek to enforce the debt through the Courts. This may result in a charge being placed on the entity’s property. Statutory Interest of 8% per annum will be applied to any penalty unpaid after 28 days.

Ready to File an "Overseas Entity Update Statement"? Read our detailed guide and simplify your compliance process.

Penalty Appeal

If you receive a penalty notice, you have the option to appeal to the High Court (or the Court of Session in Scotland). You can appeal if you believe that the decision to impose a financial penalty, or the amount or type of the penalty:

- is illegal

- is illogical or unreasonable

- is based on a procedural error or otherwise violates the principles of natural justice

To initiate an appeal, you must obtain the Court's permission within 28 days of receiving the penalty notice. Additionally, you need to inform the registrar through email or written communication within 7 days of applying for permission to appeal.

Conclusion

In conclusion, Register Of Overseas Entities (ROE) aims to enhance transparency in foreign ownership of UK property. Non-compliance by overseas entities may result in property transaction restrictions, criminal prosecution, and civil financial penalties.

The Act provides a framework for penalties, considering post-warning registrations and allowing appeals to the Court based on specific grounds.