The evolving landscape of overseas entities and its regulations has been adjusting into a plethora of changes. More than 6 months has passed since the deadline of disclosing details about registerable beneficial owners and relevant trusts.

HMRC has been adhering towards a compliant development of information collection for Oversea Entities. It has also been implementing new mandates.

Let’s talk about it all.

Latest Developments in Registering Overseas Entities

Six months has passed since the passing of the mandate for overseas entities to unveil their registerable beneficial owners. And six months have gone by since this mandate has been put into effect.

During this important time, different types of information have come together. For this, HMRC has been using various techniques to collect vital information.

The Importance of Overseas Entities Information Collection

Information of this scale has provided HMRC with immense and unparalleled insight in the world of overseas entities. This kind of knowledge can be very valuable for-

- Assessment of Tax Risks

- Cross-Referential Analysis between new and existing information

The Change in the Overseas Entities Landscape

From the early months of February (2022) to the start of the year, January (2023)- this in-between period, marks a significant transition in the world of Overseas Entities. This has all been due to HMRC’s new regulations.

Changes ranging from registrable beneficial owners to trust beneficiaries becoming disclosable has made this period immensely significant.

Undisclosed Income Reporting

The new introduction of HMRC’s disclosure facility has offered a path for reporting undisclosed income effectively. This new mandate serves to rectify any unintentional or undisclosed non-compliance in an efficient manner.

The Unveiling of True Ownerships

HMRC as stated earlier has been collecting various Types of Information On Overseas Entities. Specifically, HMRC’s integration of non-public trust information from Companies Houses has yielded unparalleled insight into the actual beneficial ownership of UK properties.

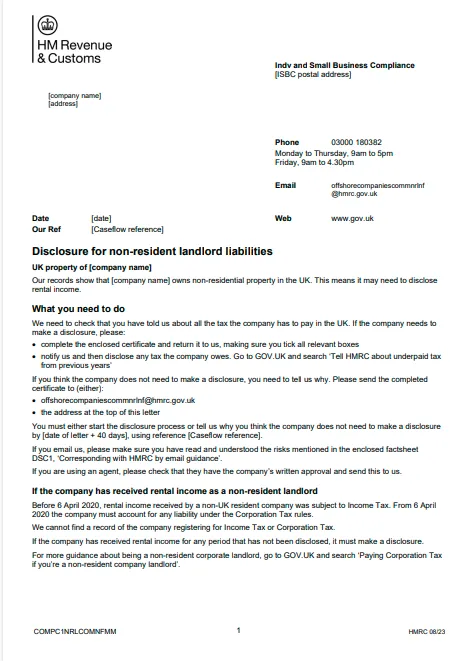

Non-Resident Landlord Tax Disclosure Notice

This notice from HMRC addresses non-resident landlords with UK property, outlining their obligation to disclose rental income. It explains the steps to follow, including completing the enclosed certificate and notifying HMRC of any tax owed.

This notice also emphasizes the importance of compliance, provides contact information, and highlights the attachment of the factsheet DSC1 for guidance on corresponding with HMRC via email.

A New Wave of Compliance Initiatives

For ensuring compliance between HMRC and Overseas Entities, HMRC has initiated a very proactive method of arrangement. For this, it has initiated a staged programme of activities.

These activities and programmes focus primarily on-

- Addressing errors in applying asset transfer legislation

- Evaluating Transfer Pricing

- Scrutinising Inheritance Tax Charges

The Enhancement in Transparency

Various amendments have been proposed to the Register of Overseas Entities (ROE) via the Economic Crime and Corporate Transparency Bill. What all these amendments have in common is, the want for reinforcing transparency.

These efforts and these amendments that have come forth aim to uncover the beneficial owners, even in the cases of corporate settlors and trusts.

Actions for Non-Compliance

Various Entities that have yet to be registered on the ROE (Register of Overseas Entities) are being identified & different targeted efforts are being directed towards non-compliance cases.

For this, collaboration between Companies Houses and the Department of Business and Trade has brought forth the commitment to compliance.

Complexities in Tax Affairs

Without a doubt, there’s an inherent complexity in tax affairs. And this nature of tax affairs calls for a proactive approach.

For the removal of these kinds of complexities relating to Oversea Entities or any tax related affairs, one should seek a professional advice. Here are a few steps on how you can reduce these kinds of complexities-

- Seeking Advice from Qualified Professionals

- Get Help from HMRC directly

- Aligning with evolving Laws

- Considering anti-avoidance provisions

Disclosure of Unpaid Tax

Individuals from all sectors involving taxes, are encouraged to consider their tax positions meticulously. Through the new disclosure facility on GOV.UK, individuals have been provided with a channel to report unpaid tax.

Issues of Fraudulent Activities

In the case of any fraudulent activities, the contractual disclosure facility has decided to offer a more appropriate avenue for resolution. This underscores HMRC’s commitment to addressing diverse scenarios of non-compliance.

Conclusion

Stay informed and take appropriate action by visiting GOV.UK to access HMRC’s disclosure facilities and valuable resources. Embrace this transparency, uphold your commitment to compliance and ensure a secure financial future.