If you’re an employer or employee in the United Kingdom, you’ve probably heard the term “PAYE” being thrown around quite a bit. PAYE, which stands for Pay As You Earn, is the system that HM Revenue and Customs (HMRC) uses to collect income tax and National Insurance contributions from employees’ wages.

Whether you’re new to the workforce or a seasoned employer, understanding PAYE and how to register for it is crucial. In this article, we’re going to give you a complete guide on PAYE and PAYE registration.

What is PAYE?

PAYE, which stands for Pay As You Earn, is the system that HM Revenue and Customs (HMRC) uses in the UK. It's the way employers collect taxes like Income Tax and National Insurance contributions from employees' paychecks.

As an employer, you need to register for PAYE and include it in your payroll system. This is crucial because it lets us calculate and take the right amount of tax from employees' earnings as they get paid.

We do this 'at source,' which means we deduct the necessary amounts before our employees receive their wages.

On or before each payday, we have to report to HMRC about how much our employees made and what deductions we've made. We also need to pay the PAYE bill. We can choose to do this either every month or every three months.

This ensures that we stay on top of our tax and contribution responsibilities and keeps everything running smoothly.

If you're running a company as a director, here's something you should know for PAYE registration, you're considered an employee of your own company. That means, even if you don't hire any other staff, you'll probably need to get your company registered for PAYE.

Why? Because you'll be paying yourself a director's salary and possibly some expenses, and the taxman needs to keep tabs on that.

Under what conditions is PAYE Registration required?

Before we dive into what it takes to register for PAYE, let's go over seven key things you should know when you're hiring staff for the first time.

- First up, figure out how much you should pay your new employee. It's important to pay them at least the National Minimum Wage.

- Make sure your employee has the legal right to work in the UK. Depending on your line of work, you might need to do other employment checks as well.

- If you work in a field that requires a DBS check (formerly known as a CRB check), be ready to apply for one, especially if you work with vulnerable people or in security.

- Employment insurance is a must. You'll need employers' liability insurance as soon as you become an employer.

- Send all the job details, including the terms and conditions, in writing to your employee. If you're hiring someone for more than a month, you'll also need to provide them with a written statement of employment.

- Inform HM Revenue and Customs (HMRC) by registering as an employer. You can do this up to four weeks before you pay your new staff.

- Lastly, check if you need to enrol your staff in a workplace pension scheme automatically.

Taking care of these steps will not only help you with PAYE but also ensure a smooth hiring process for your new staff.

Now that we have covered those seven essentials for hiring staff, it's time to talk about registering as an employer with HMRC and setting up PAYE. If your company falls under one or more of the following conditions, you need to register as an employer with HMRC and set up PAYE:

- If you pay at least one employee, which includes company directors, a minimum of £123 per week (£533 per month or £6,396 per year). This is in line with the NIC Lower Earnings Limit for the 2023/24 tax year.

- When you employ someone who's already working another job or is receiving a pension.

- If your company provides expenses or benefits to any of your employees or directors.

- When you hire subcontractors for work within the construction industry.

These are the situations where you'll need to get your PAYE registration in order to manage your tax and contribution responsibilities.

Is PAYE Registration required for Self-Employed and Sole Traders?

If you operate as a self-employed individual or a sole proprietor and only pay yourself (for information regarding employing others, refer above), you do not fall under the category of an employer, and there is no requirement for you to establish a PAYE system prior to disbursing your own compensation.

In situations where you also hold employment with another organisation, it is the responsibility of that employer to handle PAYE registration, and you are not obliged to do so.

However, it's essential to note that being self-employed doesn't mean you are exempt from tax obligations entirely. Instead of having Income Tax and National Insurance contributions automatically withheld from your earnings through PAYE, you will need to complete a Self Assessment Tax Return.

At the conclusion of each tax year, HMRC will compute the tax amount you owe based on the information you provide, which you will then remit during the subsequent financial year.

What are the responsibilities if PAYE registration is not applicable?

If none of the above conditions apply to any of your employees or company directors, you're in the clear – there's no need to register as an employer or run PAYE.

But remember, you still have other responsibilities. You'll need to collect and keep the below payroll records:

- Payments to your employees and the deductions you make from those payments.

- Any reports you submit to HM Revenue and Customs (HMRC).

- Payments made to HMRC.

- Records of employee leave and sickness absences.

- Notices regarding tax codes.

- Details of taxable expenses or benefits provided to employees.

- Documents related to the Payroll Giving Scheme, including the agency contract and employee authorisation forms.

It's essential that your records accurately reflect your reporting, and you must retain these records for a period of three years from the conclusion of the tax year to which they pertain.

What kinds of payments and deductions are handled through PAYE?

Employers can use PAYE to process various types of payments and make several PAYE deductions through payroll each payday, which may include such as:

|

Payments |

Deductions |

|---|---|

|

Salaries and Wages |

Income Tax |

|

Bonuses and commission |

Employees’ Class 1 National Insurance Contributions |

|

Non-cash tips |

Employees’ pension contributions |

|

Some specific expenses |

Repayments for Student Loan and Postgraduate loan |

|

Pensions |

Child maintenance payments |

|

Statutory Sick Pay (SSP) |

Donations through Payroll Giving (Give As You Earn) |

|

Statutory Maternity, Paternity, and Adoption pay |

Payments under an attachment of earnings order |

|

Redundancy pay |

Repayments of a loan made by the employer to the employee |

Additionally, if an employee earns more than £175 per week (which is £758 per month), an employer has to pay an additional fee called "Class 1 employer's National Insurance." This is a contribution that employers make on top of the employee's salary.

Step by Step Process of PAYE Registration

The majority of employers have an obligation to establish their online PAYE system. This must be done prior to the initial payday, but you cannot initiate the employer registration or set up PAYE more than two months in advance of your actual payment commencement.

Keep in mind that it might take HMRC a few weeks to complete the registration process and furnish you with all the necessary PAYE details. Therefore, it's advisable to initiate this procedure well in advance to ensure ample time for processing.

Step 1: Gather Required Information

To initiate the PAYE registration process, you should collect specific information pertaining to your business. Make sure you have the following details readily accessible:

- Name of Business

- Trading name

- Company’s Registration Number

- Address of Registration

- Contact details, including telephone number and email address

- Number of Employees

- Start date of Business

- First Pay date

- Pension enrolment date

- Details on Sub-contractor (if available)

- Whether your company will be operating an occupational Pension Scheme

- At least one director’s details and National Insurance number

Step 2: Visit HMRC’s website and fill required information

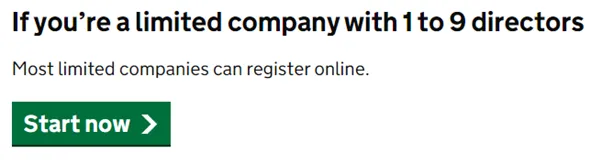

Visit HMRC’s Register as an employer webpage and select ‘Start now’ as shown below:

After clicking on ‘Start now’ You will be asked to answer the following questions:

- Does at least one company director have a UK National Insurance Contribution number?

- Is the company an offshore employer outside the Europe Economic Area that does not pay UK National Insurance?

- Overt the next two months, will the company pay out any non-cash incentive awards?

The screen will then confirm whether you can register online.

Step 3: Choose to register online/offline

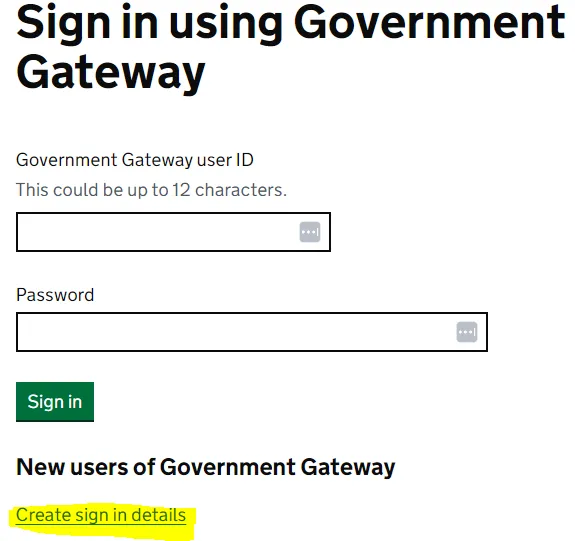

If online registration is an option for you, click on 'Continue' and log in to your company's Government Gateway account.

If you don't have an existing account, choose 'Create sign-in details' located at the bottom of the screen. This option will enable you to establish a new business tax account for your company.

After selecting ‘create sign-in details’, follow these steps:

- Input your email address.

- Keep an eye on your inbox for an email sent by HMRC containing a 'Confirmation Code.' Enter this code as instructed.

- Provide your full name.

- Generate a password.

- Set up a recovery word, which will be useful in case you forget your password in the future.

- Take note of your Government Gateway user ID, which will be displayed on the screen.

- Select the appropriate account type by choosing 'Organisation.'

- You will then be directed to your newly established business tax account.

Be sure to record your login details and save the Government Gateway sign-in page as a bookmark for future reference. This is the portal through which you will access all of your company's tax accounts, which may include Corporation Tax, Value Added Tax (VAT), and PAYE.

Step 4 Registering for PAYE as a Limited Company

Within your business tax account, you will encounter a prompt to add or select the specific tax registration you require. Opt for 'PAYE for Employers.'

Indicate that you are registering your limited company and proceed to input your company's Unique Taxpayer Reference (UTR).

The UTR, a 10-digit number, is assigned by HMRC to all newly formed companies. You should expect to receive a letter containing your company's UTR at your registered office address within approximately three weeks from the date of company formation.

Step 5: Completing the PAYE Registration Form

Moving forward, you'll need to specify the first payday for your employees, including any directors, and furnish all the details mentioned in step 1 in the registration form.

Once the form is completed, you can submit the application online and save a copy for your own records.

Step 6: Receiving Letter from HMRC

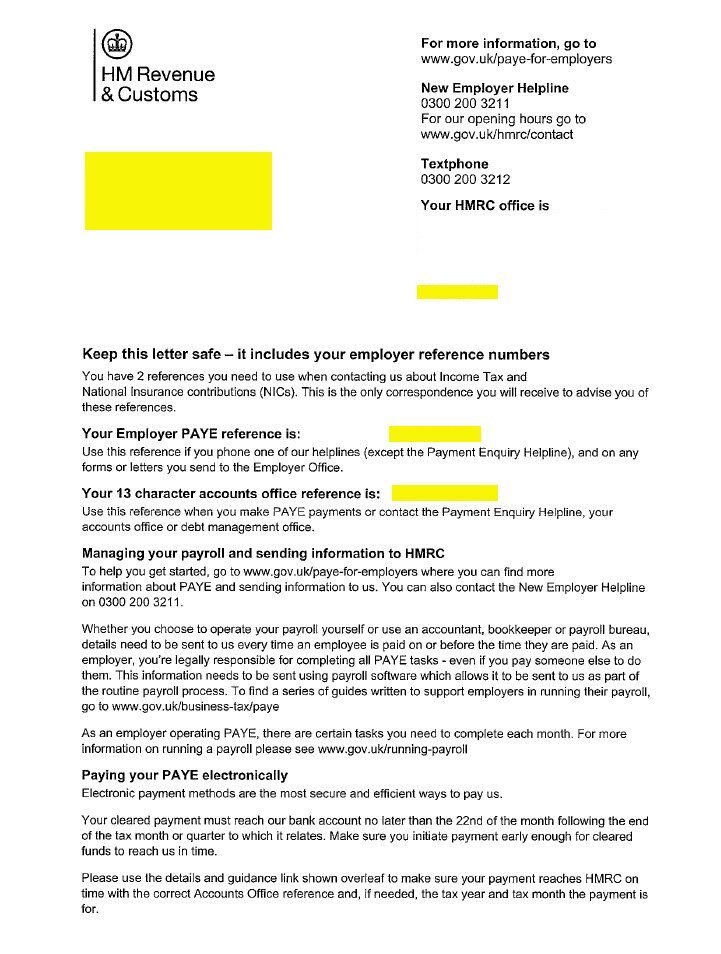

You can expect to receive a letter within 15 days of your employer registration, which will contain your Employer PAYE reference and Accounts Office reference. A sample of letter has been attached below for your reference:

Sample PAYE Registration Letter

Both the Employer PAYE reference and Accounts Office reference are of significant importance. They are vital for establishing your payroll system, submitting reports, and remitting PAYE tax and National Insurance contributions to HMRC. It's crucial to securely store this letter along with your other company records.

Step 7: Activate PAYE Online Service

In the final step, HMRC will dispatch an Activation Code (sometimes referred to as an Activation Pin) by mail, typically arriving within ten days of your enrolment completion. It is essential to utilise this code to activate your PAYE Online service within 28 days from the date mentioned in the letter.

Explore our PAYE Registration Services!

For which businesses is online registration not available?

Certain businesses cannot register for PAYE online. These include:

- Companies with ten or more directors.

- Companies where none of the directors possess a UK National Insurance number.

- Offshore employers (including those on the Isle of Man) who do not pay UK National Insurance.

- Companies offering non-cash incentive awards as part of employee compensation packages.

- Insurance companies and other entities are responsible for disbursing sick pay to employees under multiple employers.

For these categories of companies, the registration process with HMRC must be conducted via phone instead of the online method.

Stay on the Right Side of the Law: Learn How to Ensure Compliance with "Payroll Tax Reporting Regulations". Read Now.

What are the Advantages of a PAYE Online account?

The PAYE Online account offers several advantages, including:

- Convenience: It provides a convenient and efficient way to manage your payroll, taxes, and National Insurance contributions online.

- Instant Access: You can access your account 24/7, allowing you to check your financial information and complete tasks at any time that suits you.

- Prompt Payments: You can make PAYE payments online, ensuring that they are received by HMRC in a timely manner.

- Record Keeping: The account keeps a record of your payment history, helping you keep track of past transactions and compliance with tax regulations.

- Communication: You can receive important notifications and notices regarding your employees, directors, and tax codes directly through the account.

- Appeals and Reporting: You can use the account to appeal penalties and report expenses and benefits, streamlining administrative tasks.

- Alerts: HMRC can send you alerts for late reporting or payments, helping you avoid penalties and stay compliant with PAYE deadlines.

- Simplified Tax Management: The account simplifies tax management, making it easier to calculate and submit your PAYE tax and National Insurance contributions.

- Cost-Efficiency: Using PAYE Online can reduce paperwork and administrative costs associated with traditional payroll processes.

- Accuracy: It helps minimise errors in your payroll and tax reporting by providing easy access to updated information and automated calculations.

Overall, the PAYE Online account streamlines payroll and tax-related activities, making it an efficient and convenient tool for businesses and employers.

What are the PAYE reporting requirements?

Under HMRC’s ‘Real Time Information’ (RTI) system, most employers are required to file all PAYE information electronically using RTI-compatible payroll software.

Every month, for tax purposes, there's something called a "tax month." It starts on the 6th of one month and goes until the 5th of the next month.

Just before you pay your employees, you have a few reporting requirements:

- Write down how much money each employee is getting paid, like their regular wages and any extra they earn.

- Work out how much money should be taken from each employee's pay for things like Income Tax and National Insurance.

- Calculate the National Insurance money the employer has to pay (Class 1), based on what each employee earns.

- Make pay slips for all employees, including any directors.

- Send all the information about what you've paid and the deductions you've made to HMRC. You do this using something called a Full Payment Submission (or FPS for short).

So, it's all about keeping track of money when you pay your employees and making sure you follow the tax rules.

Things to remember

- You must include all your employees in your PAYE system, even if they earn less than £123 a week.

- If you don't pay any of your employees during a tax month, you need to send HMRC something called an "Employer Payment Summary" (EPS) instead of the usual report (FPS).

- It's important to know that you as an employer don't handle or report dividend income through PAYE. If an employee gets dividend from your company, it's employee’s responsibility to report that income and pay tax on it using "Self Assessment."

Ready to take control of your " UK payroll taxes and deductions ". Read our comprehensive guide now and ensure compliance with confidence.

Things to do after each payday

- After each payday, in the following month, you can check how much you need to pay (if anything) in your PAYE Online account. This information is available from the 12th of that month.

- If you need to claim a reduction, like for statutory pay, on what you owe HMRC from your last Final Payment Submission (FPS) report, you should send an "Employer Payment Summary" by the 19th of the month.

- To see the exact amount you owe, sign into your PAYE Online account. You'll find this information within two days (or by the 14th if you sent an EPS before the 11th).

- To pay your PAYE bill, you have until the 22nd of the month (or the 19th if you're sending payment by mail).

If your PAYE bill is usually less than £1,500 a month, HMRC might allow you to pay once every three months instead of monthly.

Consequences of not reporting PAYE information on time

HMRC may issue a penalty if:

- Your Full Payment Submission (FPS) was submitted after the deadline and

- You failed to send:

- The required number of FPSs.

- An Employer Payment Summary (EPS) when you did not pay any employees in a tax month.

Amount of Penalty

The amount of Penalty for not reporting PAYE information on time depends on the number of employees you have.

|

Number of employees |

Monthly penalty |

|---|---|

|

1 to 9 |

£100 |

|

10 to 49 |

£200 |

|

50 to 249 |

£300 |

|

250 or more |

£400 |

If you're a new employer and you don't send a report to HMRC within 120 days, your PAYE scheme will be shut down.

In addition to the possible penalties for your company, delayed payroll reports can impact the income-related benefits of your employees, like Employment and Support Allowance (ESA) and Universal Credit.

However, check this out to find out the conditions where you may not face immediate penalties for not reporting PAYE information on time.

Things to remember while Cancelling PAYE Registration

If you are a business owner and circumstances change, such as you no longer have employees or consistently earn less than £123 per week, it's crucial to inform HMRC and cancel your PAYE (Pay As You Earn) registration.

Here are points to remember while cancelling PAYE registration:

Send a Final Payroll Return

To begin the process of cancelling your PAYE registration, you need to send a final payroll return to HMRC. This can be either a Full Payment Submission (FPS) or an Employer Payment Summary (EPS). The final return is important because it notifies HMRC that you are ceasing your PAYE scheme.

Check the 'Final Submission Because Scheme Ceased' Box

When submitting your final return, ensure that you check the box labelled 'Final submission because scheme ceased.' This informs HMRC of the reason for the termination of your PAYE scheme.

Enter the Date of Scheme Cessation

In the 'Date scheme ceased' box, you need to enter the precise date on which you officially closed your PAYE scheme. Importantly, you cannot enter a future date here; it must be the actual date on which you cease being an employer.

Submit Any Expenses and Benefits Returns

If applicable, you should submit any expenses and benefits returns. Make sure all financial aspects related to your employees are correctly accounted for before proceeding.

Enter a Leaving Date for Each Employee

Within your payroll records, you need to enter a leaving date for each of your employees. This is an essential step, as it helps HMRC and your employees to understand when their employment with your company officially ends.

Deduct and Pay Outstanding Tax and NIC

You must deduct and pay any outstanding tax and National Insurance Contributions (NIC) to HMRC. You typically have 17 days to make this payment, but if you wish to pay by cheque, the deadline is shortened to 14 days.

Provide P45 Forms to Employees

On the last day of your employees' work, it's your responsibility to provide them with a P45 form. This document outlines their earnings and tax contributions while under your employment. If your payroll software cannot generate P45s, you can order them directly from HMRC.

Final Thoughts

Understanding PAYE (Pay As You Earn) and its registration process is essential for both employers and employees in the UK. PAYE is the system through which HM Revenue and Customs (HMRC) collects income tax and National Insurance contributions from employee wages.

Registering for PAYE is a crucial step for employers, ensuring that tax deductions are made 'at source' before employees receive their earnings.

It's important to be aware of the specific conditions that necessitate PAYE registration, such as paying employees a minimum of £123 per week, providing expenses or benefits, or hiring subcontractors in the construction industry.

The above step-by-step guide for PAYE registration covers the information required, activating an online account, and the advantages of using the online system.

Compliance with reporting requirements and adherence to deadlines are paramount to avoid penalties. Cancelling PAYE registration when circumstances change is also detailed in the guide, ensuring a smooth transition and compliance with HMRC regulations.

In simple terms, knowing about PAYE and how to sign up for it is crucial for keeping your finances in order and for effectively handling payroll and tax duties.