If you own a residential property and have failed to declare your rental income to HMRC, you could face significant penalties. Depending on how late the disclosure was made and the reasons it wasn’t made in the first place, such penalties can range from 100% at the upper end to 0% at the lower end.

In this article, we will discuss the penalties that landlords can face for failing to comply with the Let Property Campaign (LPC) in detail.

You can check out our Complete Guide to Let Property Campaign to understand an overview of the Let Property Campaign and how it works, so that you can make an informed decision about whether to participate.

Non-Disclosure Penalties on Let Property Campaign

Non-Disclosure penalties for the LPC can take two forms :

- Penalties for failure to notify

- Penalties for inaccurate returns

Penalties for Failure to Notify

When an individual fails to notify HMRC of the tax he owes within the appropriate deadline, penalty for failure to notify is levied.

A person who solely had employment income that was subject to PAYE tax and hadn’t previously filed a self-assessment tax return may be in this situation.

Penalties for Inaccurate Returns

If the individual has already filed the tax return but has yet to report his property income, penalty for inaccurate returns is levied. The penalty rate for filing incomplete or incorrect self-assessment returns is different from that for not filing them at all.

It is important to be aware of the disclosure requirements and to ensure that all necessary information is reported to avoid any potential legal or financial consequences.

Steps for Calculating Penalties for Let Property Campaign

One of the key components of the Let Property Campaign is the calculation of penalties for those who fail to declare their rental income.

To find out what the penalty rate should be for an individual landlord, follow the steps below :

Calculate Penalty for LPC

Step 1: Calculate the Potential Lost Revenue (PLR) Amount

The Potential Lost Revenue (PLR) is the additional tax amount payable by the landlord after taking into consideration of undisclosed property income.

To calculate the PLR, first identify the amount of undisclosed income and then multiply it by the relevant tax rate.

Step 2: Identify the ‘Behavior’ & Know Your Penalty Range

While deciding the penalty rate, HMRC considers the underlying behaviour of the landlord, such as whether he came forward voluntarily or to what extent he is willing to assist in the assessment.

|

Unprompted Disclosure |

Prompted Disclosure |

|---|---|

|

Unprompted Disclosure occurs when a landlord comes forward voluntarily and decides to disclose his income before HMRC begins a compliance check. |

Prompted Disclosure occurs when HMRC identifies undiclosed income from a UK Property during a compliance check. In this case, HMRC sends a letter to such landlords. |

I. Penalty for Failure to Notify

|

Type of Behaviour |

Unprompted Disclosure |

Prompted Disclosure |

|---|---|---|

|

Non-deliberate-within 12 months |

0% to 30% |

10% to 30% |

|

Non-deliberate-12 months or more |

10% to 30% |

20% to 30% |

|

Deliberate |

20% to 70% |

35% to 70% |

|

Deliberate and Concealed |

30% to 100% |

50% to 100% |

Behaviour

For purpose of penalty calculation, the landlord’s behavior can fall into one of the below categories:

Non-Deliberate

If the landlord’s intention was not to conceal the income from HMRC, but rather unaware of some facts or was in some circumstances that caused the non-Disclosure, he may face a lower penalty.

Deliberate But Not Concealed

If the landlord despite acknowledging that he should have declared rental income but chose not to do so, his behavior is referred to as Deliberate but not Concealed.

Deliberate And Concealed

The landlord’s action is considered as Deliberate & Concealed if he not only refuses to declare income but also actively takes steps to conceal it from HMRC. Such individuals face penalties at a higher rate.

II. Penalty for Inaccurate Returns

|

Type of Behaviour |

Unprompted Disclosure |

Prompted Disclosure |

|---|---|---|

|

Reasonable Care |

No Penalty |

No Penalty |

|

Careless |

0% to 30% |

15% to 30% |

|

Deliberate |

20% to 70% |

35% to 70% |

|

Deliberate and Concealed |

30% to 100% |

50% to 100% |

Behaviour

For purpose of penalty calculation, the landlord’s behavior can fall into one of the below categories:

Reasonable Care

There is not any specific definition for reasonable care behavior prescribed by HMRC. Whether or not reasonable care was taken by landlords is judgemental since what may appear reasonable to one may not be so to another.

The landlords, according to HMRC, should at least have some basic knowledge or, if they do not, pursue proper advice to understand the correct tax treatment of what they are unfamiliar with.

Careless

If the landlords fail to take reasonable care to correct inaccuracies in return, then HMRC views it as Careless behavior.

Deliberate

If the landlord, despite being aware of inaccuracies in return, files it to HMRC, then HMRC charges a penalty for his intentional error. Examples of this could be understating business income, or overstating income in return.

Deliberate And Concealed

Deliberate and concealed is the case where the landlord not only files inaccurate returns but also actively takes steps to conceal the inaccuracies from HMRC. Examples of this could be supplying HMRC with a fake invoice to cover non-occurred repairs.

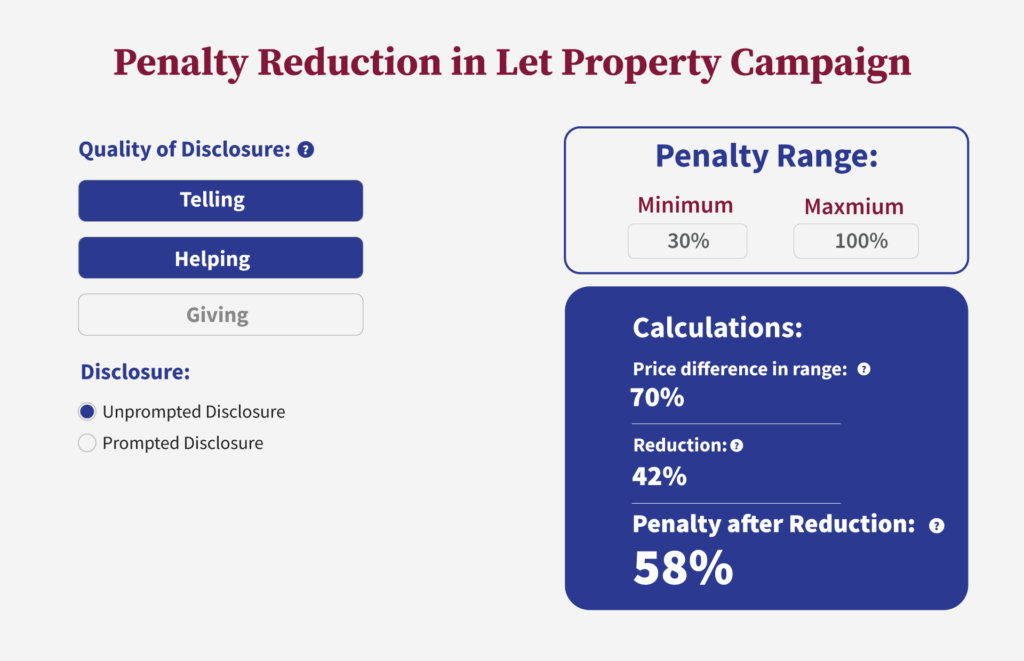

Step 3 : Calculate the reduction in penalty for the Quality of Disclosure

A quality of disclosure implies the degree of assistance the landlord provides to HMRC during their case assessment. Alternatively, it concerns how honest the landlord is & how well he liaises with HMRC.

Penalty Reduction in Let Property Campaign

You should also consider that the penalty can be reduced based on the quality of disclosure under the Let Property Campaign. The penalty reduction is applied on the difference between the maximum & minimum penalty rate of the range it falls.

This can serve as a form of responding to their questions, helping with their assessment, or granting them access to archives & documents wherever required.

Telling

Helping

Giving Access to Records

Let’s assume, the penalty range is 30% to 100%, and the reduction for Quality of Disclosure is 60% (30% telling + 30% helping + 0% giving). The mechanism of penalty reduction is illustrated below:

Note: If there is a failure to notify, the quality of Disclosure is also affected by how long it took to the landlord to make a Disclosure. The maximum penalty reduction in such a context is limited to 10%.

Step 4: Find out Your final Penalty amount

Lastly, multiply the final penalty percentage rate with PLR to get the penalty amount charged under the Let Property Campaign.

Examples

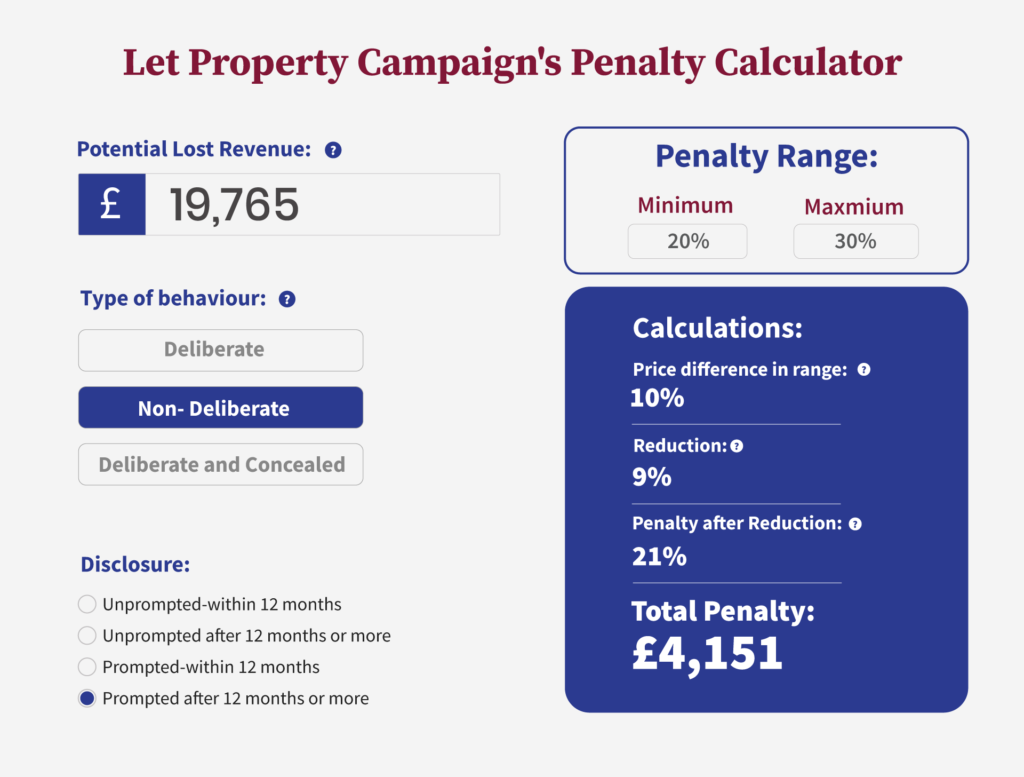

Penalty Failure to Notify

HMRC discovers that Mr. Wen owes a property in the UK but hasn’t disclosed his income. As HMRC initiated a check, the case is prompted. Despite not disclosing it before, his intention was not to deliberately hide it from HMRC.

So, the penalty for a prompted non-deliberate failure to notify of more than 12 months ranges from 20% to 30%. The reduction in the quality of Disclosure (telling, helping, and giving) was 90%.

Calculation of Penalty :

The total penalty to be paid by Mr. Wen is £4,151.

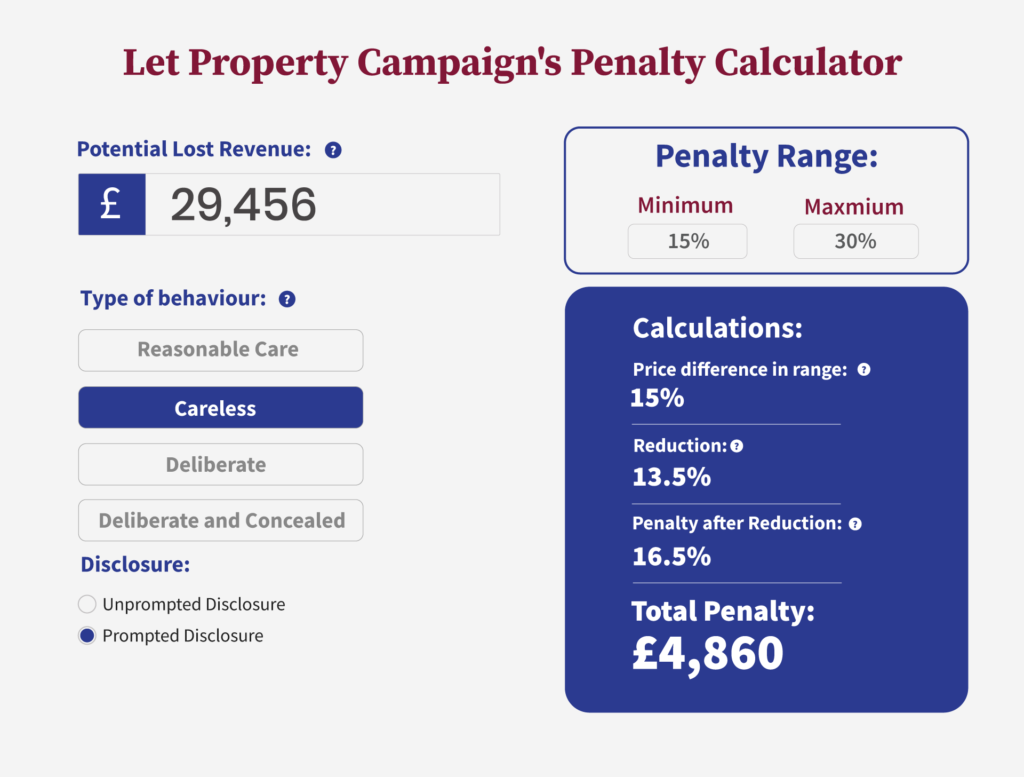

Penalty for Inaccurate Returns

HMRC run a compliance check and found Mr Unic has not disclosed his property income in his prior self-assessment return. So, the penalty for inaccurate returns will be levied.

His behavior was identified as careless inaccuracy, and the penalty range for him is 15% to 30%. The reduction in the quality of Disclosure (telling, helping, and giving) was 90%.

Calculation of Penalty:

The total penalty to be paid by Mr. Wen is £4,860.

Are you Seeking to Declare Your Rental Income Through LPC?

Look no further than UKPA. Our track record of success in handling multiple Let Property Campaign cases speaks for itself.

Partnering with us means not only achieving a seamless resolution of your tax affairs but also benefiting from reduced penalties and interest charges. In fact, some of our clients have even avoided penalties altogether.

Don’t let undeclared rental income keep you up overnight. Trust UKPA to guide you through the Let Property Campaign and ensure your peace of mind.

We are dedicated to solve your queries.

Contact us for assistance at any stage of your journey.