In the United Kingdom, tax regulations related to property ownership and income are crucial to understand for anyone who receives rental income or other proceeds from UK land or property. The UK tax system requires individuals to report income from various property-related sources, including letting furnished rooms in their own home, income from furnished holiday lettings, premiums from leasing UK land, and even inducements related to property transactions.

In this article, we will delve into the importance of correct filling UK Property Page when you receive income from these sources and highlight some key aspects to consider.

Why is it Necessary?

The UK tax system operates on a self-assessment basis, which means it is the taxpayer’s responsibility to report their income and determine the tax they owe. This applies to income from property as well. Failing to report your property-related income accurately can result in fines, penalties, and even legal consequences. Therefore, it is crucial to understand which sections of your tax return pertain to UK property and how to correctly fill them in.

When is it Required?

You must complete the ‘UK property’ pages if you receive:

Rental Income and Other Receipts

If you receive rental income from UK land or property, you must report it. This includes income from residential and commercial properties, whether you are an individual landlord or a business. Additionally, other receipts related to property, such as service charges and fees, should be accounted for.

Income from Letting Furnished Rooms

Individuals who earn income from letting furnished rooms in their own home also need to report. The UK government allows homeowners to earn a certain amount of tax-free income under the Rent-a-Room scheme, but anything above this threshold should be reported. This helps ensure that you are paying the correct amount of tax on your rental income.

Income from Furnished Holiday Lettings

If you are engaged in furnished holiday lettings (FHL) in the UK or the European Economic Area (EEA), the income you generate from this activity must be reported. FHL properties are subject to special tax rules, and it’s essential to provide accurate information to the tax authorities to take advantage of these rules.

FHLs are lets which satisfy the following conditions:

- Furnished

- UK or EEA

- Available for let for at least 210 days

- Actually let for 105 days (the ‘letting’ condition)

- Longer-term occupation not more than 155 days (longer-term occupation is a continuous period of more than 31 days)

Premiums from Leasing UK Land

If you receive premiums for leasing UK land, whether it’s for a long-term lease or a one-time transaction, this income should be included. Premiums are typically taxed as income, and their value can vary greatly. Reporting them correctly ensures you meet your tax obligations.

Inducements to Take an Interest in Letting a Property

In some property transactions, you might receive inducements, also known as reverse premiums, to take an interest in letting a property. These should also be reported, particularly if their value exceeds £1,000. Accurate reporting of these inducements is essential to avoid tax issues down the line.

The Basics of the Property Income Allowance

The property income allowance is a beneficial provision in the UK tax system that allows individuals to earn income from property up to £1,000 without incurring any tax liability. This means that if your property income, including income from foreign property, does not exceed £1,000, you won’t need to report it on your tax return. This can simplify your tax responsibilities and save you both time and effort. It should be noted that whether you have one property business or more than one property business, the total amount of property income allowance claimed cannot exceed £1,000.

Checking Eligibility

Before deciding whether to claim the property income allowance, it’s essential to ensure that you qualify for it. Meeting these criteria is essential to benefit from the allowance and avoid any potential issues with HM Revenue and Customs (HMRC).

When to Skip the Property Income Allowance

In some situations, individuals may choose not to claim the property income allowance. Two common scenarios in which you might bypass the allowance include:

- When Allowable Expenses Exceed Turnover

If your allowable expenses are higher than your property income turnover, you may prefer not to claim the allowance. This choice allows you to calculate your property profits by deducting your allowable expenses and other relevant allowances.

- Non-Resident Landlords

Non-resident landlords who wish to claim back tax paid under the non-resident landlord scheme may opt not to use the property income allowance.

Example

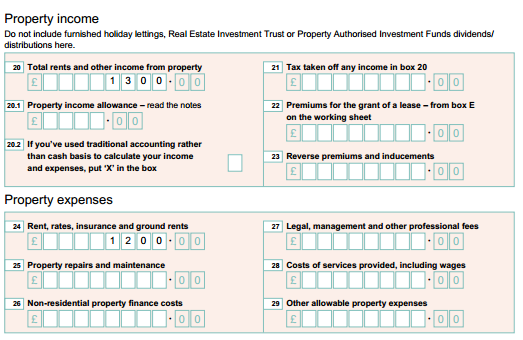

If your total rental income amounts to £1,300, and your expenses are £900, opting to claim the property allowance in Box 5.1 for FHL and Box 20.1 for UK property income would be more advantageous.

When utilising the property income allowance, you cannot deduct any eligible expenses or claim any other allowances.

- If your total rental income amounts to £1,300, and your expenses are £1,200, it is more beneficial to claim expenses and allowances in Box 6-12 for FHL and Box 24-29 for UK property, where relevant.

When claiming allowable expenses and allowances, you cannot claim the property income allowance.

Traditional Accounting or Cash Basis

The traditional accounting, also known as accrual basis, provides a more comprehensive perspective on your property business finances. It considers all earned income and incurred expenses, whether or not they have been received or paid.

On the other hand, the cash basis offers a simplified approach to calculating your property business profits or losses. It involves totalling your property income received and subtracting any allowable expenses paid in the tax year. You’re eligible for the cash basis if your total income from UK property (including UK FHLs) or income from foreign property (including EEA FHLs) is up to £150,000.

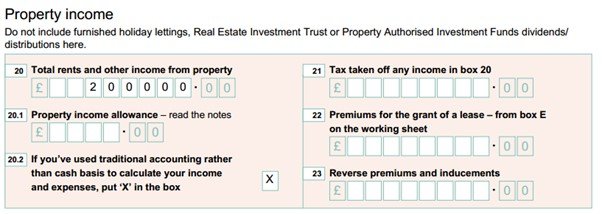

You must tick Box 5.2 for FHL and 20.2 for UK Property if you’ve used traditional accounting instead of cash basis. Same accounting basis must be used if you have income from FHL in the UK along with UK Property income.

Question: What should I do if I changed my accounting basis this year?

If you changed your accounting basis this year, you must make a transitional adjustment. All the transitional receipts must be entered into Box 5 for FHL and Box 20 for UK Property, and all transitional expenses must be entered into Box 9 for FHL and Box 29 for UK Property.

Property Income

For UK Property income, enter your total property rental income, excluding income from FHLs in Box 20. This must include income from various sources such as tenancy, leasing or licensing agreements, land, various accommodations, etc.

For Furnished Holiday Lettings, you must enter the total amount of income from all your FHLs in Box 5.

If you are a non-resident landlord, include your gross amount (without tax taken off) of income in Box 5 for FHL and Box 20 for UK Property and any tax taken off in Box 21.

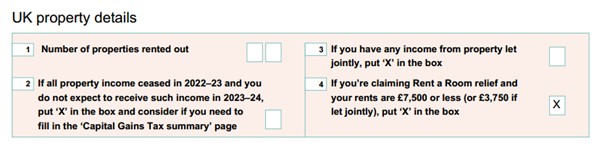

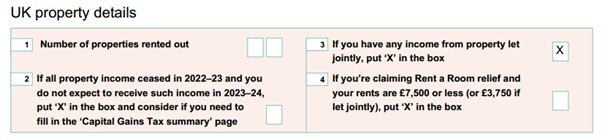

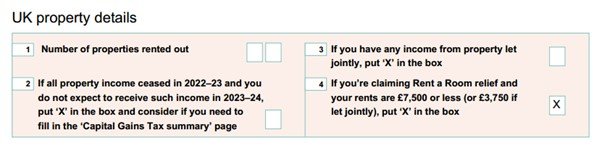

Joint Property Income

Box 3 comes into play if you’re earning income from jointly owned property. Each co-owner is responsible for reporting their share of the income and associated expenses on the ‘UK property’ pages of the tax return. You must report the income in boxes 5 for FHL or 20 for UK property, and the loss in boxes 9 for FHL or 29 for UK property.

If you live with your spouse, the default is to split the tax liability equally. However, if you prefer a different arrangement, you can use form 17, ‘Declaration of beneficial interests in joint property and income’.

Income from Letting Furnished Rooms

If you’re renting out furnished rooms in your home and your total income falls below the Rent a Room Relief of £7,500 (£3,750 if rented jointly), box 4 must be filled. If this is your sole rental income, there’s no need to fill out the remaining sections of the UK property pages. This means you won’t have to pay tax on this rental income.

However, if your total income exceeds the exemption, skip box 4 and consider these options:

- You can claim Rent a Room Relief and opt to pay tax on the surplus amount without deducting any expenses. Record your total income in box 20 and the exempted amount of £7,500 (or £3,750) in box 37.

- Note: Property income allowance cannot be applied to Rent a Room income in this scenario.

- Alternatively, you can calculate your profit from the rental in the usual way, subtract allowable expenses (found in boxes 24 to 29) from the amount in box 20. In this case, leave box 37 blank.

- Premiums for Grant of Lease.

- Any premiums for the grant of a lease are regarded as income if you’re claiming property income allowance. For leases up to 50 years, the premium is treated as part capital and part income. You must include the income in Box 22.

- Reverse Premiums and Inducements.

- If you received any payment or benefit as an inducement to take an interest in a property, you should report it in box 23. Please note that reverse premiums are regarded as income if you’re claiming property income allowance as well.

- Partnership Property Income.

- If your income from a partnership includes property income, it is essential to complete the ‘Partnership (full)’ pages.

- Overseas Property Income.

- If you generate income from land and property overseas, it is necessary to complete the ‘Foreign’ pages. However, income from a furnished holiday letting (FHL) in the EEA should be recorded in the ‘UK property’ pages. If your FHL income is subject to taxation on the remittance basis, the ‘Foreign’ pages must be filled.

- If you intend to claim Foreign Tax Credit Relief for any foreign tax paid on your EEA FHL, complete the section titled ‘Foreign tax paid on employment, self-employment, and other income’ on page F 6 of the ‘Foreign’ pages.

- Property Expenses.

- Furnished Holiday Lets Expenses.

- If your overall property income, including FHL income, is under £85,000 before deducting expenses, simply aggregate your FHL expenses and record the total in box 9.

- Note that if you’re claiming the property income allowance, you are not allowed to subtract any allowable expenses or apply for other allowances on this income. Therefore, do not fill in boxes 6 to 10 or box 11.1 to box 12.

| Box | Expense | Description |

|---|---|---|

| 6 | Rent paid, repairs, insurance and costs of services provided | Rents, rates, insurance, and ground rent. Property repairs and maintenance. Costs of services provided, such as wages. If you’re claiming insurance against loss of rents, note that if you receive any money under your insurance policy, report it in box 5. |

| 7 | Loan Interest and Financial Costs | Interest on the loan or finance payments regarding the purchase of a property rented out. |

| 8 | Legal, Management, and Other Professional Fees | Management fees paid to an agent for rent collection, advertising, and administration. Legal and professional fees for renewing a lease (if the lease is for less than 50 years). Professional fees incurred for evicting an unsatisfactory tenant to re-let the property. Any costs associated with appealing against a compulsory purchase order. You’re not eligible to claim the following: Costs related to the first letting or subletting of a property for more than a year. Costs associated with agreeing and paying a premium on the renewal of a lease. Fees paid for planning permission or the registration of title during property purchase. |

| 9 | Miscellaneous Property Expenses | Stationery, phone, business travel, and other miscellaneous costs. A portion of a premium paid to a landlord for the lease if you’re subletting. Any foreign tax deducted from your EEA FHL income (unless you’re claiming Foreign Tax Credit Relief on the ‘Foreign’ pages). If you’re a non-resident FHL landlord, report the UK tax deducted in box 21. |

UK Property Expenses

You can claim the running costs of your business. However, you cannot include the cost of buying, selling, improving, or altering any land, property, equipment, furnishings, or furniture as these are considered capital costs.

| Box | Expenses | Decription |

|---|---|---|

| 24 | Rent, rates, insurance, ground rents etc | Rent for a lease of a property you let Business rates, and water rates Council tax Property and contents insurance If you’re claiming insurance against loss of rents, note that if you receive any money under your insurance policy, report it in box 20. Ground rents |

| 25 | Property repairs and maintenance | Exterior and interior painting Damp treatment to combat moisture issues Stone cleaning Roof repairs Furniture repairs Machinery repairs to keep everything running smoothly |

| 26 | Non-residential property finance costs | Costs of getting a loan, or alternative finance to buy a non-residential property that you let, and Any interest on such a loan or alternative finance payments |

| 27 | Legal, Management, and Other Professional Fees | Management fees paid to an agent for rent collection, advertising, and administration. Legal and professional fees for renewing a lease (if the lease is for less than 50 years). Professional fees incurred for evicting an unsatisfactory tenant to re-let the property. Any costs associated with appealing against a compulsory purchase order. You’re not eligible to claim the following: Costs related to the first letting or subletting of a property for more than a year. Costs associated with agreeing and paying a premium on the renewal of a lease. Fees paid for planning permission or the registration of title during property purchase. |

| 28 | Costs of services provided, including wages | Any services provided to tenants such as, communal hot water, gardening or cleaning. Wages |

| 29 | Miscellaneous Property Expenses | Stationery, phone, business travel, and other miscellaneous costs. A portion of a premium paid to a landlord for the lease if you’re subletting. Irrecoverable debts written off (but only if you are not using cash basis) |

Residential Property Finance Costs

The costs of getting a loan, or alternative finance to buy a residential property that you let or any interest on such a loan or alternative finance payments cannot be claimed. However, you can use these costs to calculate a reduction in Income Tax by putting the amount of residential property finance costs in Box 44.

This tax reduction will be calculated as the lower of:

- 20% of the finance costs not deducted from income in the tax year plus any unrelieved amount brought forward from the previous year.

- The profits from the property business, or adjusted total income, that exceeds the personal allowance.

Other Property Considerations

Adjustment for Private Use

Fill Box 10 for FHL and Box 30 for UK Property.

If you included expenses that wasn’t solely for the business, you must enter the non-business portion in Box 10 for FHL and Box 30 for UK Property.

For instance, if you listed the entire annual cost of insuring the FHL property in box 6 but only rented it out for 8 out of 12 months because you used it for 4 months, place the 4 months’ non-business cost in box 10.

Balancing Charges

Fill Box 11 for FHL and Box 31 for UK Property.

Balancing charges may occur after a disposal or balancing event, such as the sale, loss, or destruction of assets, or when business use ceases and the proceeds from the event exceed their tax value.

If you sell an item on which you’ve claimed capital allowances, and the sale proceeds or item value surpasses the pool value or cost, you’ll be liable for tax on the difference (referred to as a ‘balancing charge’). This includes items where the pool value is nil due to previously claiming the full cost.

Note: Any balancing charges are considered income if you’re claiming the property income allowance.

Capital Allowances

For FHLs,

| Box | Particulars |

|---|---|

| 11.1 | Electric Charge-Point Allowance (100% First Year Allowance) |

| 11.2 | Zero-Emission Car Allowance (100% First Year Allowance) |

| 12 | Other Capital Allowances |

For UK Property,

| Box | Particulars |

|---|---|

| 32 | Annual Investment Allowance (AIA) |

| 33 | Structures and Buildings Allowance (SBA) |

| 33.1 | Electric Charge-Point Allowance (100% First Year Allowance) |

| 33.2 | Freeport Structures and Buildings allowance |

| 34 | Zero-Emission Goods Vehicle Allowance (100% First Year Allowance) |

| 34.1 | Zero-Emission Car Allowance (100% First Year Allowance) |

| 35 | Other Capital Allowances |

Costs of replacing domestic items (for residential non-FHL lettings only)

You’re eligible to claim the cost of replacing domestic items in your residential accommodation under the following conditions:

- The expense is related to purchasing a replacement domestic item.

- The new item is exclusively for the tenants’ use, and the old item is no longer available for use.

If the new item represents an improvement over the old one, your claim is limited to the amount required to replace the original item.

Conclusion

In conclusion, accurately navigating the UK tax system, especially concerning property income, is vital for individuals. By adhering to the guidelines outlined, taxpayers can fulfil their legal obligations, optimise their tax positions, and make the process of reporting property-related income more informed.