HM Revenue and Customs (HMRC) now holds more information than they already had. With this, HMRC are sending letters and inviting UK individuals to bring their tax who have undeclared income. The common way of communicating has been issuing of ‘One to Many’ Letters by HMRC. The ‘One to Many’ letters issued to date have covered varying range of topics from Overseas income and gain, Research and Development, Partnership Discrepancies, etc.

One to Many (OTM) involves sending a letter to many people. The letters address past, present, and future tax difficulties and invite taxpayers to reconsider. These are called “nudge letters” because they seek to change taxpayer behaviour.

HMRC have recently been targeting the UK individuals with short-term property letting income. This article aims to discuss in detail about the letter HMRC is sending to such UK individuals.

Tax Implications of Short-Term Property Letting

In the United Kingdom, short term letting refers to the practise of renting out a property, whether it is a room, flat or house, for a short period of time, usually less than six months. This type of rental arrangement is also known as a short-term rental, holiday rental, or serviced accommodation.

Short-term rentals can be found in a variety of places, including online platforms like Airbnb or booking.com, as well as through letting agents and property managers who specialise in short-term rentals. They are frequently used by travellers or visitors seeking a flexible and cost-effective alternative to traditional hotels or other long-term rental options.

An individual supplying short-term accommodation in the UK should be aware of the following two taxes:

Income Taxes

When you earn income in the UK from short-term property letting the income is ordinarily treated as rental income. The individuals are required to file the UK income tax return by the due date (31 January) and make the necessary tax payment.

The UK income tax rates are as follows:

- Tax free personal allowance on the first £12,570

- 20% for the next £37,700

- 40% for income up to £150,000

- 45% above £150,000.

Value Added Tax

You are required to register for the VAT in the UK if the value of the service provided is expected to be more than £85,000 or you expect that the total value of your supplies in the next 30 days will exceed the threshold.

You are required to register for the VAT in the UK if the value of the service provided is expected to be more than £85,000 or you expect that the total value of your supplies in the next 30 days will exceed the threshold.

If you provide short term property letting and the turnover exceeds the threshold limit, you need to charge the VAT on the supplies that you make to your guest

Capital Gain Tax

In the UK, people who rent their properties out for a short period of time may have to pay capital gains tax on any profits they make from selling the property.

During the tax year 2022–2023, there is a capital gains tax exemption threshold of £12,300, which indicates that if your gains fall below this amount, you won’t incur any CGT. This threshold has decreased for the year 2023/24, totalling at £6,000.

Stamp Duty Land Tax

First-time buyers may be eligible for a discounted rate or exemption from SDLT. It’s important to factor in SDLT when budgeting for a property purchase, as it can significantly increase the overall cost of the transaction.

Sample Letter from HMRC for Short-term Property Letting

The one-to-many letter is a type of letter sent by HMRC to many taxpayers who are believed to have a certain type of tax liability. The content of the letter typically includes a brief explanation of the tax issue, details of any relevant legislation, and guidance on how to rectify the issue.

The letter may also provide a deadline for responding and may warn of potential penalties or further action if the issue is not resolved. The tone of the letter is usually formal but informative, and it is designed to prompt a response from the recipient in order to resolve the tax issue as quickly and efficiently as possible.

The sample of the letter of HMRC’s OTM letter is below:

Dealing With One-To-Many Letters For Short-Term Property Letting Income

If you have received a letter from HMRC, it is probable that you have made money from short-term property lettings without giving this information to the government. This is the case if you have made money from short-term property lettings. There is also the possibility that you will be required to make tax payments on that money.

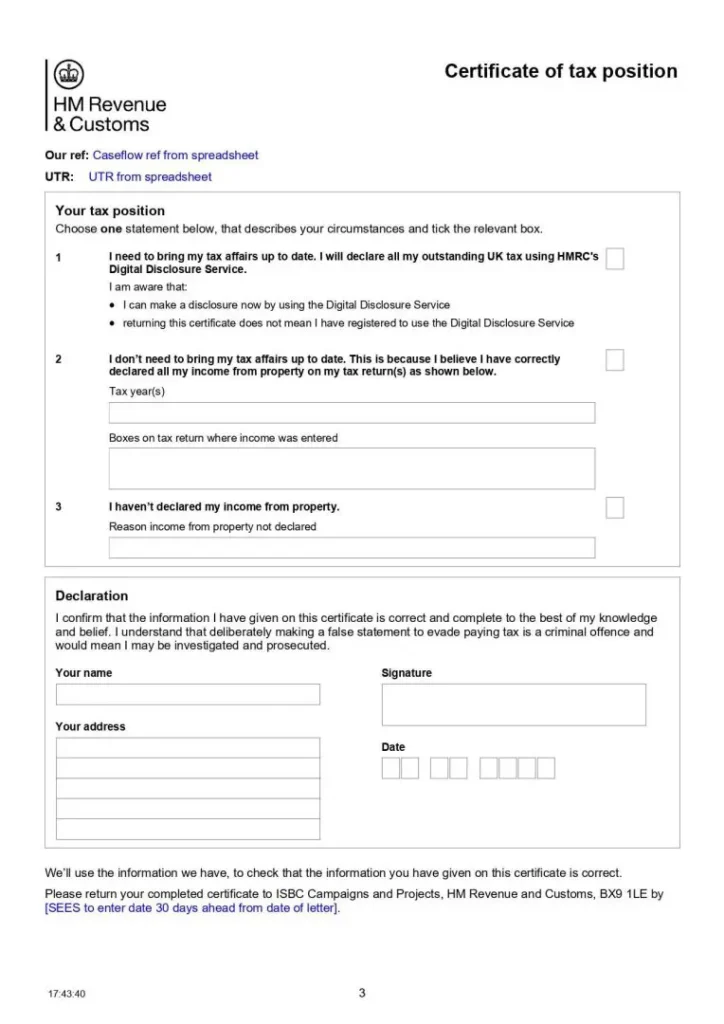

In a situation such as this one, the HMRC would recommend that you fill out a “certificate of tax position” and return it back to them within a period of thirty days after doing so.

It is crucial to be aware that making a false statement with the intention of avoiding tax payment is considered a criminal breach, and that doing so could lead to an investigation as well as the possibility of criminal prosecution. If you make such a statement, it is imperative that you are aware of this fact.

What options do I have?

You can choose between the following options if you have received the HMRC’s One-to-many letter for Short Term Property Letting Income:

- Declaring all the outstanding UK tax using HMRC’s Digital Disclosure Services. This can be done by completing a certificate of Tax Position and making an online digital Disclosure.

- You will have to work out your tax you owe and pay within 90 days of receipt of an acknowledgement letter.

- Declaring that all the income has been correctly disclosed and do not need to bring the tax affairs up to date. This can be done by completing and sending a certificate of tax position or sending an explanatory letter confirming the tax position.

- Declaring that income from property has not been disclosed and the reason for it. In this case, HMRC will open an enquiry into your tax affairs and based on the assessment, an additional late payment interest and penalties may have to be paid.

Cautions While making Short- Term Property Letting Declaration

Making a disclosure for short-term property letting requires caution if you are a landlord who has received HMRC’s “one to many” letter. While renting out short-term properties can be a lucrative business, making false or late tax declarations can have serious legal and financial repercussions.

Listed below are some of the precautions to keep in mind when making a declaration for short-term property letting.

- Making an incorrect declaration through the Tax Position Certificate can have severe consequences, so it’s important to understand your position before acting.

- The Tax Position Certificate is not mandatory by law, but it can be completed at any time for any tax year.

- There are three options provided in the certificate, and the appropriate statement(s) to select depend on individual circumstances.

- The money received from short-term property letting may cover multiple tax years, so accurate information must be provided.

- Completing the certificate can be complicated due to limited space, so a written response may be a more appropriate course of action for complex tax matters.

- HMRC accepts responses in the form of a letter if the certificate is not completed.

It is preferable to respond to HMRC by letter and not complete the certificate if the tax affairs are not straightforward, as making a false declaration can have severe consequences.

We are dedicated to solve your queries.

Contact us for assistance at any stage of your journey.