The rental income from the property is charged to Income tax under section 22 of the Income tax Act, 1961. Any income from leasing or renting out of the property is taxed under the head “income from house property.”

An Assessee is charged tax under income from house property if:

- The property should consist of buildings or lands

- The assessee must be the owner of the property

- The property is used as an investment property and not used in their own business.

The property can be held as stock in the trade of a business.

Type of House Property and taxability:

1. Let Out Property: Always Taxable

2. Self-Occupied Property (SOP):

i. SOP (Business & Profession): Ignore

ii. SOP (Residence): a. Two SOP: Exempt

b. More than two SOP: For two SOP is Exempt while remaining SOP will be treated as Deemed to be Let Out property and is taxable.

The taxability of the property income under the head ‘income from house property’ begins with the identification of the Gross Annual Value (GAV) of the property.

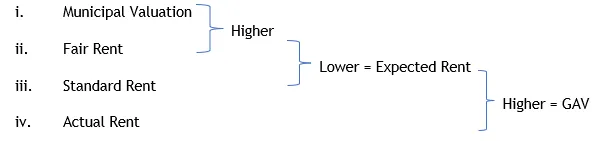

Gross Annual Value is computed as below:

Municipal valuation tax is allowed on payment basis and only if paid by owner.

Concept of Vacancy

In case the rent remains vacant in any part of the year, if the total of actual rent and vacancy rent (actual rent proportionally calculated for part of vacant period) exceeds Expected Rent then Actual Rent shall be treated as GAV.

However, if the total of actual rent and vacancy rent remains in below the expected rent then Expected Rent shall be treated as GAV.

As complicated as this look, we can explain this more from the given example:

A house is let out in Delhi for 60,000 annual rent. The value determined by the municipal authorities for levying municipal taxes on house property is 65,000 for the year.

The rent of a similar property in the same location is also 65,000.

However, the rent fixed by the Rent Control act is 58,000.

What is the Gross Annual value of the property?

|

Particular |

Amount |

|---|---|

|

i. Municipal Value |

65,000 |

|

ii. Fair Rent |

65,000 |

|

iii. Higher of (i) & (ii) |

65,000 |

|

iv. Standard Rent |

58,000 |

|

v. Expected Rent Lower of (iii) & (iv) |

58,000 |

|

vi. Acutal Rent |

60,000 |

|

vii. GAV i.e., higher of (v) & (vi) |

60,000 |

What are the other Deductions allowed from Annual Value?

A standard deduction of 30% of Annual value and deduction of interest on borrowed capital is allowed.

The 30% deduction is a flat rate deduction irrespective of the actual expenditure incurred.

However, the flat rate deduction of 30% is not allowed in case of self-occupied property.

Other expenses like repair & maintenance, society charges, parking charges, insurance charges, electricity & water charges, lift charges, etc are not allowed as these are all deemed to be covered under the flat rate deduction.

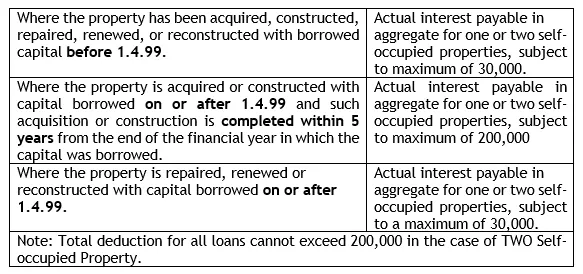

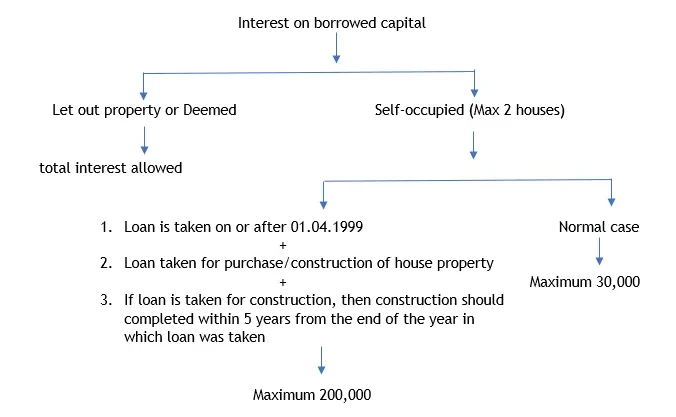

There is a ceiling for the maximum limit for deduction in respect of interest on capital borrowed.

To Summarise:

Some additional points:

1. In case interest on such loan is to be paid to party outside India then deduction of such interest shall be allowed only in case assessee deduct TDS on such interest and pay to Government within due dates.

2. Any fresh loan is taken for repayment of earlier loan and earlier loan was taken for the purpose of house property then interest of fresh loan shall be allowed as deduction.

3. Pre-construction/Acquisition Interest: It means interest paid before the year in which construction was completed. It is allowed in Five equal instalments from the year in which construction was completed.

If the house is party let out and party self-occupied, then Municipal value, fair rent, standard rent, municipal taxes, and interest on loan should be divided between the Self-occupied and let out portion based on area.

But Actual rent should never be divided because it is always for Let-out property.

In case property is let out on basis of time then such property is treated as Let out property only; for e.g. property let out for even for 1 day then it is LOP.

The income tax is exempt up to two self-occupied properties.

Any property, in addition, will be regarded as a deemed let out, and the Gross Annual value of such property is computed as per what we have discussed above.

*However, interest on loan on such self-occupied property can be taken into account.

Where the house property or any part of the property is not let during the whole or any part of the previous year, the annual value of such property or part of the property, for the period up to two years from the end of the financial year in which the certificate of completion of construction of the property is obtained from the competent authority shall be taken as Nil.

The actual rent, as discussed above, is computed as

Actual rent = Rent received + receivable – unrealised rent

The rent not recovered from the tenant will be regarded as Bad debt and deducted while computing the actual rent.

BUT!

The following conditions must be fulfilled:

- The tenancy should be bona fide

- The tenant should have vacated that house property

- Such tenant should not occupy any other house property of the same assessed

- A reasonable step should have been taken for the recovery

As unrealised income is regarded as bad debt, any income which is now recovered will be taxable under head house property irrespective of whether you still own the property.

The taxable amount is 70% of such recovery.

Concept of Composite Rent

Composite rent means rent of House property and rent of other assets and amenities.

In such case, we need to see as to what the agreement beholds, if agreement of such is not separable then total rent shall be taxable under income from other source of profit or gain from business or profession.

If agreement is separable, rent of house property shall be taxable under income from house property while rent of other assets shall be taxable under income from other source of profit or gain from business or profession.