In a recent announcement during the Autumn Statement, Chancellor Jeremy Hunt revealed a significant cut in National Insurance (NI) for approximately 29 million workers. While this news may bring relief to many, it’s essential to understand the broader context of previous NI and income tax changes, as the overall tax burden for millions is expected to reach record levels.

What is National Insurance?

National Insurance (NI) stands as the second-largest revenue source for the government, applying universally across the UK. Similar to income tax for employees, a fixed percentage of earnings is deducted from wages, with employers also contributing to NI contributions (NICs). Eligibility for certain benefits, including the state pension, is contingent on the amount of NICs contributed.

National Insurance Changes

Commencing January 6, 2024, 27 million workers will experience a reduction from the current 12% to 10% on earnings between £12,571 and £50,270. Chancellor Hunt estimates that this cut translates to a £450 annual saving for a worker earning £35,400.

For the UK’s two million self-employed individuals, changes are also on the horizon. Starting April 6, 2024, they will see a decrease from 9% to 8% on profits between £12,571 and £50,270. Simultaneously, the separate category of National Insurance, Class 2 contributions, will no longer apply. The government asserts that this cut will save an average self-employed person £350 annually.

National Insurance Thresholds

As earnings rise, more individuals will be subject to National Insurance (NI) payments due to a frozen income threshold (£12,570). Formerly, these thresholds increased annually in line with inflation, but Chancellor Hunt has confirmed their freeze until April 2028.

Income Tax Implications

Similar to NI, Income tax thresholds are also frozen until 2028, leading to an increase in the number of taxpayers. This freeze, coupled with higher inflation, is anticipated to elevate the overall tax burden to its highest level since the post-war era, according to the Office for Budget Responsibility (OBR).

Current Rates of Income Tax

The basic rate of income tax (20%) applies to earnings between £12,571 and £50,270. The higher rate (40%) is levied on earnings between £50,271 and £125,140, with an additional rate (45%) for income exceeding £125,140.

|

Tax Rate |

2022/23 Tax Band Threshold |

2023/24 Tax Band Threshold |

2024/25 Tax Band Threshold |

|---|---|---|---|

|

Personal Allowance |

£0-£12,570 |

£0-£12,570 |

£0-£12,570 |

|

Basic Rate Income Tax |

£12,571-£50,270 20% |

£12,571-£50,270 20% |

£12,571-£50,270 20% |

|

Higher Rate Income Tax |

£50,271-£150,000 40% |

£50,271-£125,140 40% |

£50,271-£125,140 40% |

|

Additional Rate Income Tax |

£150,000 upwards 45% |

£125,140 upwards 45% |

£125,140 upwards 45% |

Scottish Variations

In Scotland, income tax rates differ due to devolved powers. Notably, a new 45% rate for those earning between £75,000 and £125,140 was announced by the Scottish government. These changes take effect in April 2024.

|

Tax Rate |

2022/23 Tax Band Threshold |

2023/24 Tax Band Threshold |

2024/25 Tax Band Threshold |

|---|---|---|---|

|

Personal Allowance |

£0-£12,570 |

£0-£12,570 |

£0-£12,570 |

|

Starter Rate |

£12,571-£14,732 19% Tax |

£12,571-£14,732 19% Tax |

£12,571-£14,876 19% Tax |

|

Basic Rate |

£14,733-£25,688 20% Tax |

£14,733-£25,688 20% Tax |

£14,732-£26,561 20% Tax |

|

Intermediate Rate |

£25,689-£43,662 21% Tax |

£25,689-£43,662 21% Tax |

£26,562-£43,662 21% Tax |

|

Higher Rate |

£43,663-£150,000 41% Tax |

£43,663-£125,140 42% Tax |

£43,663-£75,000 42% Tax |

|

Advanced Rate |

– Not In Use |

– Not In Use |

£75,001-£125,140 45% Tax |

|

Top Rate |

Over £150,000 46% Tax |

Over £125,140 47% Tax |

Over £125,140 48% Tax |

Tax and the UK Economy

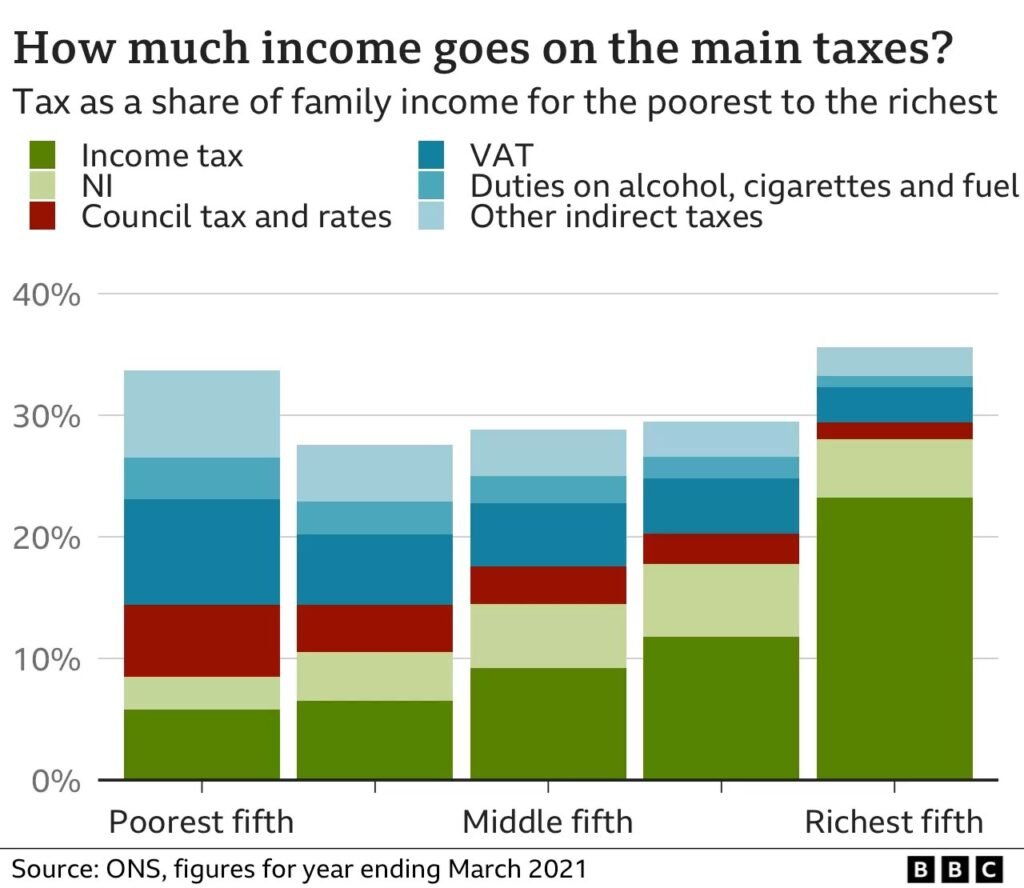

Despite these alterations, the tax-to-GDP ratio is projected to rise, reaching 38% of GDP in the next five years – a post-war high, as per the OBR. While the UK stands in the middle of the G7 in terms of tax raised as a proportion of the economy (33.5% in 2021), the shifts in tax policies are likely to impact households across the spectrum.

As the landscape of taxation evolves, understanding these changes becomes crucial for individuals navigating the intricacies of their financial obligations. The implications of these adjustments extend beyond individual paychecks, shaping the economic landscape and influencing the fiscal well-being of households across the UK.