Commercial buildings, compared to residential ones, have a tax advantage. They can claim 3% (2% before April 2020) of the cost of the building.

This is called Structure and Building Allowance (SBA). The business can claim 3% of the cost every year. Claim can be made for 33 years and 4 months.

Businesses must stop claiming SBA once building is disposed of, used for residential purpose, not used for business, or demolished.

Who can claim an SBA?

Businesses must meet the below criteria for claiming SBA on building or structure:

- Construction had begun (and contract was agreed) on or after 29 October 2018.

- The first use of the building was for non-residential purpose.

- The claimant must have relevant interest in the qualifying expenditure

Additionally, the building must be used by the claimant for qualifying activities. (CAA 2001, s.270CA, 270CB, 270CD)

Qualifying Expenditure for SBA

Capital expenditure incurred in commercial building qualify for SBA. It includes cost of acquiring a building as well as the cost of constructing (renovating, extending, or refurbishing) the existing building.

Note: Certain costs like the cost of purchasing land (including SDLT, legal fees, seeking planning permission) is not eligible and must be deducted from total eligible cost.

Qualifying Expenditure - Construction Cost

Cost of making a building, preparing the land for construction or demolition, renovation cost and incidental repair etc are qualified for SBA.

SBA is also available on survey and design costs of a constructed building.

Costs related to land like restoring or cleaning de-contaminated or derelict land, landscaping etc do not qualify and should be excluded (unless such costs are essential before construction is carried out).

Do I need to track the yearly expenditure on refurbishment or renovation cost after acquiring the building?

Yes. Capital expenditure like refurbishment or renovation must be tracked properly. Sometimes, refurbishment or renovation work starts in one year and completes in the next. No need to split cost between two periods and SBA on whole can be claimed in either of the years.

Suppose Matthew has year-end date of 31 March. Spending £20,000, he created 2 extra rooms on the terrace.

The work started on 1 March 2023, and it took until 30 April 2023. For expense of £20,000, he can claim SBA either on year ending 31 March 2023 or on year ending 31 March 2024 (no need to proportion between two years).

Qualifying expenditure - Acquisition cost

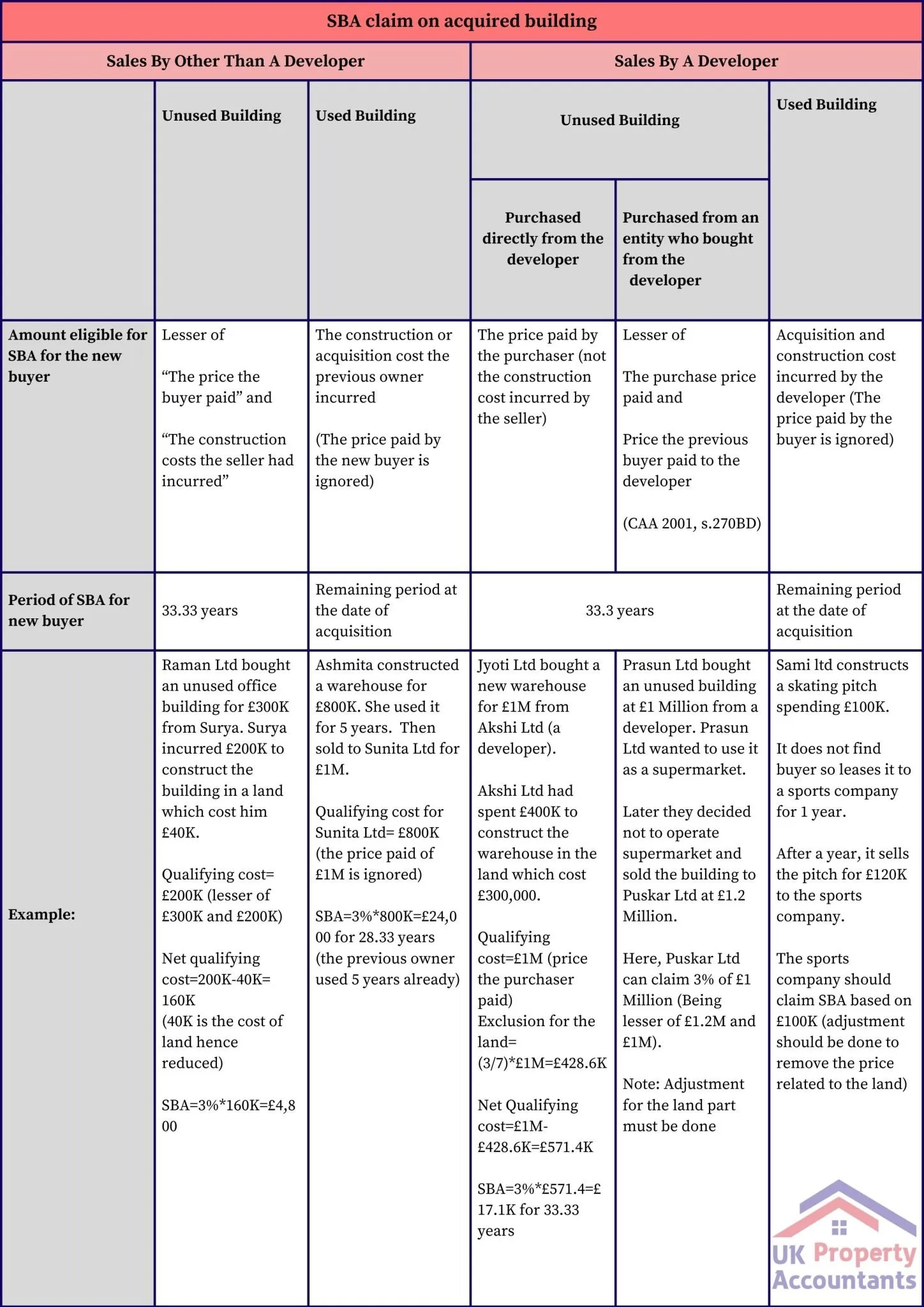

Cost of purchasing a building is eligible for SBA (cost related to land must be reduced). The amount eligible depends on various factors (explained below).

Which amount should I base my SBA calculation on? Is it the amount I paid, or the original cost incurred by the seller?

The eligible amount varies as shown below: