A lease is an agreement through which one person provides the “right to use the property” to the other person. The right is called a ‘leasehold interest’. The one granting such right is called the lessor and the one receiving such right is called lessee.

A lease variation is the change in the terms or clauses or requirements of lease (adding new terms, amending, or removing existing terms etc). For example, extending a lease, including, or restricting a right to sub-lease, responsibility for repair and maintenance etc. A lease surrender is an early termination of lease.

In this article, we are discussing how tax applies when lease undergoes variation or surrender.

Sum Received for Variation of Lease Terms

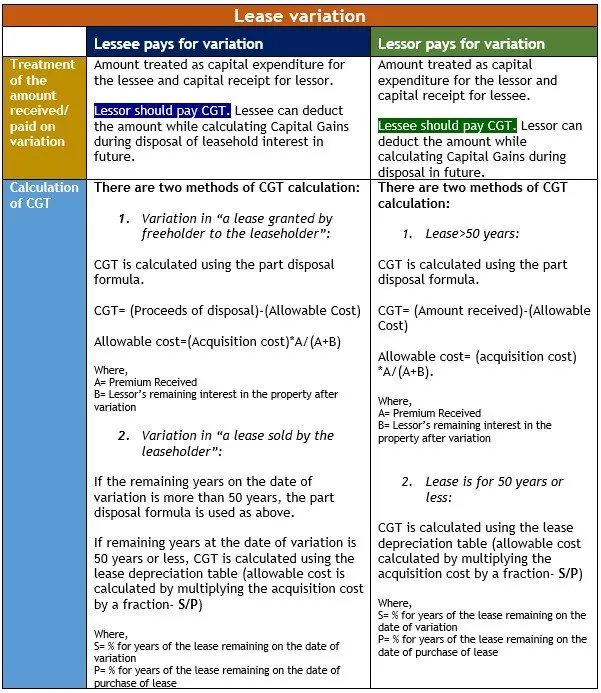

During lease variation, a payment/receipt might be involved between the lessor and the lessee. Tax treatment of such receipt depends on various factors.

Lease Variation- Lessee Paying The Lessor (CG71352)

Sometimes, a variation in the lease may be unfavourable to the lessor and favourable to the lessee. In such case, a lessee pays to the lessor for variation.

For example, a lease extension is a variation of lease. If extended for 10 more years, the lessor loses his right to use the property for those 10 years. So, he is deemed to dispose of some of his interest over the property.

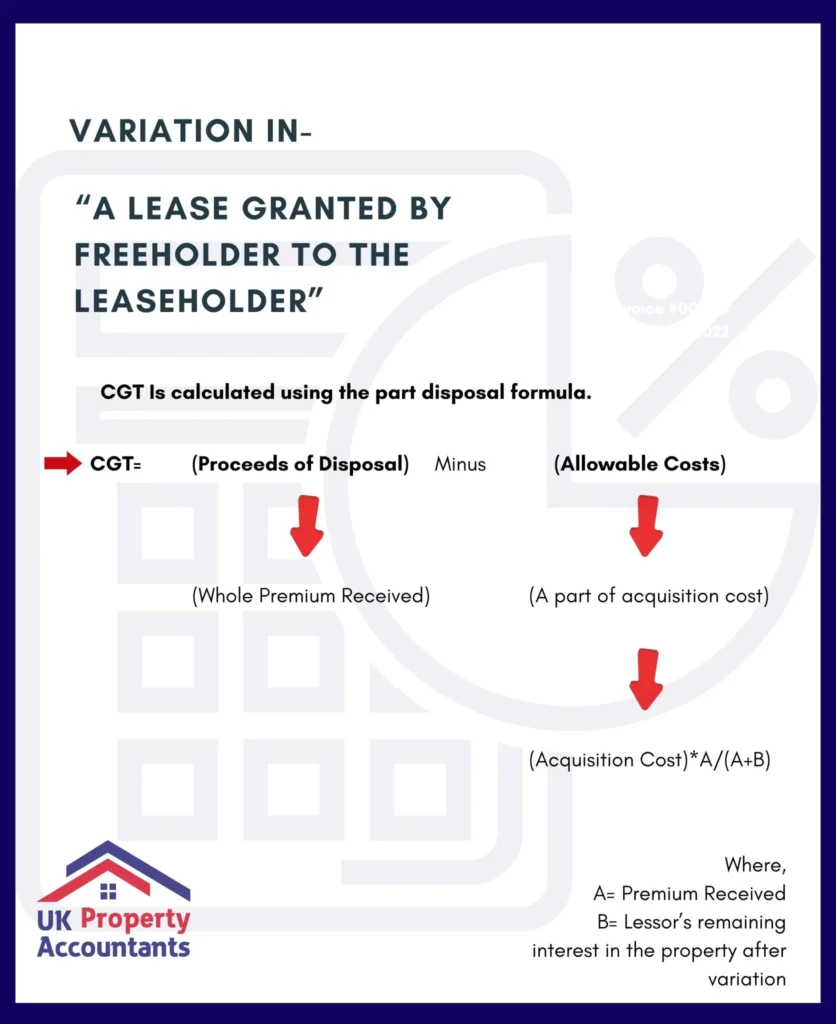

Hence Capital Gains Tax (CGT) applies. As only some of his interest is disposed of, a part disposal applies instead of full disposal. There could be two ways to calculate CGT:

Variation in “a lease sold by the leaseholder”

If the remaining years on the date of variation is more than 50 years, the part disposal formula is used as above. If remaining years at the date of variation is 50 years or less, CGT is calculated using the lease depreciation table (allowable cost is calculated by multiplying the acquisition cost by a fraction- S/P).

Where,

- S= % for years of the lease remaining on the date of variation

- P= % for years of the lease remaining on the date of purchase of lease

These percentages can be found at legislation-Sch 8 TCGA 1992.

For the lessee, since the variation enhances his right over the property, the sum paid is deemed a capital expenditure. He can deduct this amount while calculating CGT on sale of lease.

Lease Variation- Lessor Paying The Lessee

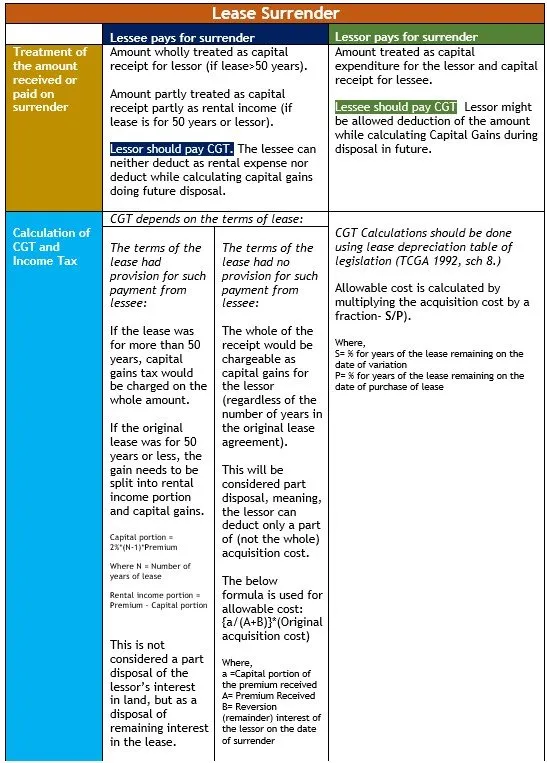

When the lessee wants to terminate the lease (before it expires) by paying the lessor, this is called lease surrender. They may want to surrender for various reasons (searching for the cheaper places, expanding their operation and needing bigger spaces, moving away to other location etc). Tax treatment on surrender will be as shown below:

Tax Treatment for The Lessor

The receipt would be treated as lease premium and CGT must be paid. There would be two ways to calculate CGT:

1. The terms of the lease had requirement for such payment from lessee:

The capital sum is not treated as a part-disposal of the lessor’s interest in the land. Rather, it is treated as disposal of the lessor’s interest in a separate asset, that is the lease.

1. The terms of the lease had requirement for such payment from lessee:

If the lease was for more than 50 years, capital gains tax would be charged on the whole amount. If the original lease was for 50 years or less, the gain needs to be split into Rental income and Capital gains (as shown in the example below).

Example(CG71262),

On 31 October 2014, Raju granted a 21-year lease of the property. Under the terms of the lease, the tenant was entitled to surrender the lease after six years on payment of £50,000. The tenant exercised this right on 31 October 2019.

Gain arising to Raju because of the surrender: 2%*(N-1)*P

Where,

P=Premium

Y= Number of years left on lease

So, Capital gains

= 2%*(6-1)*50,000

= £5,000 (remaining £45,000 chargeable to income tax)

2. The terms of the lease did not mention whether the lessee needs to pay on surrender:

The whole of the receipt would be chargeable as capital gains for the lessor (regardless of the number of years in the original lease agreement). This will be considered part disposal, meaning, the lessor can deduct only a part of (not the whole) acquisition cost. The below formula is used for allowable cost:

{a/(A+B)}*(Original acquisition cost)

Where,

a= Capital portion of the premium received

A= Premium Received

B=Reversion (remainder) interest of the lessor on the date of surrender

Tax Treatment for The Lessee

The lessee cannot deduct the amount he paid as rental expense (since this is a capital payment). Nor can he deduct this amount during future disposal (because such payment is neither acquisition cost nor enhancement expenditure).

Reverse Lease Surrender (Lessor Paying The Lessee)

If the lessor wants to terminate the lease early (before it expires), usually by paying the lessee, this is called reverse lease surrender. This might happen when he wants to use the property for other purpose or change the tenants (lessee).

Tax Treatment for The Lessee

As the lessee is giving up his right to use the property, the surrender is considered disposal of interest. Hence, the amount the lessee received for surrender is chargeable as capital gains. While calculating the capital gains, they can deduct a part of the acquisition cost (the premium they had paid on lease initially) and enhancement expenditure. Calculations should be done using lease depreciation table of legislation (TCGA 1992, sch 8.)

Tax Treatment for The Lessor

With lease surrender, the lessor is re-acquiring the interest in property, so the amount paid is deemed a capital payment. When the landlord will dispose of the property in the future, such payment could be allowable as enhancement expenditure (if the payment added value to the property).

For example, Richard had leased his building to a law firm. Later he wanted to expand the area and develop the building as a supermarket (so that he could get a higher amount of rent). For this he needed to vacate the property for a few months.

Suppose he pays £50,000 to the existing tenants to surrender the lease, then converted it into a supermarket. Afterwards, he leased it to Walmart for higher rent than previous.

Here, paying £50,000 for surrender made vacating the property possible. Because of this extension, the property value increased. Following this logic, £50,000 added to the value of the property and could be counted as enhancement expenditure for future disposal.

Notes:

- Such payment is not a deductible expense for the calculation of rental profit.

- Stamp Duty Land Tax might be payable (as the landlord is deemed to have acquired interest of the tenant).

- The lessor can claim Capital Allowances in case of payment for lease surrender. For this, a disposal value needs to be calculated on a reasonable basis, or by parties entering a joint election under CA 2001, s198.

Summary of Tax Treatment on Lease Variation and Lease Surrender

We are dedicated to solve your queries.

Contact us for assistance at any stage of your journey.