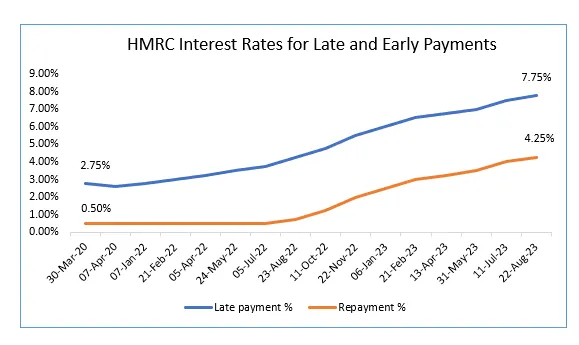

In a recent development, HMRC has announced a significant revision to its interest rates, with a striking increase in the late payment interest rate to 7.75%. This surge, effective from 22 August 2023, marks the highest rate recorded since the year 2001. The decision comes in the wake of the Bank of England’s base rate ascent to 5.25% on 3 August. Notably, these interest rate adjustments apply to the principal taxes and obligations managed by HMRC.

Implications of the Interest Rate Adjustment

As part of these alterations, the late payment interest rate will observe a 0.25% surge, reaching 7.75% starting from 22 August. This uptick follows a previous rate adjustment that occurred on 11 July. Notably, the rates are poised at a level previously witnessed in August 2007.

The scope of these adjustments covers various financial aspects, encompassing income tax, National Insurance contributions, capital gains tax, corporation tax payments and filings, stamp duty land tax, as well as stamp duty and stamp duty reserve tax. Furthermore, the corporation tax pay and file rate will also see an escalation to 7.75%.

Concurrently, the repayment interest rate will experience a slight augmentation, moving from the present 4% to 4.25%. Furthermore, the interest rate associated with corporation tax self-assessment pertaining to underpaid quarterly instalment payments will rise to 6.25% from the prior 6%, effective from the earlier date of 14 August.

Mitigating the Impact: Support for Taxpayers with Overpayments

Despite this increase in the late payment interest rate, which now stands 2.5% above the Bank of England base rate, HMRC will uphold the practice of providing lower interest to taxpayers grappling with tax overpayments. This will be maintained at 4.25%, a rise from the earlier rate of 4%.

Conversely, the interest rates applicable to overpaid quarterly instalment payments and early payments of corporation tax, not falling within the instalment framework, will observe a rise to 5% from the preceding 4.75%, effective from 14 August. This comprehensive rate adjustment landscape underscores HMRC’s commitment to maintaining fiscal equilibrium and ensuring compliance with taxation obligations.