The UK Construction Industry by nature, is dynamic and fast-paced. This calls for Construction Industry Scheme (CIS), a unique tax scheme designed for contractors and subcontractors to facilitate convenience. There are specific regulation put in place by the scheme that minimises inconsistency in workers’ wage and all their tax obligations that come with it.

You can discover the unique tax requirements, roles and responsibilities, obligations, and penalties of the CIS for both contractors.

This article will give you an overview of what the Construction Industry Scheme brings to the table for contractor’s general obligations, alongside the responsibilities that accompany it.

Who is a Contractor?

A contractor in the construction industry is an individual or company hired to perform the construction work on a project.

Construction projects can extend from large commercial or industrial buildings, roads, bridges, and other infrastructure to smaller home-based projects.

A business that is not directly engaged in construction work but has spent more than £3 million on construction-related work is also treated as a contractor for tax purposes. This type of business is referred to as the ‘Deemed Contractor’.

Obligations of a Contractor’s under CIS

Under Construction Industry Scheme, you have specific obligations as a contractor that you must fulfil.

These obligations are intended to ensure that the scheme functions properly and that all construction businesses comply with applicable tax laws.

As a contractor under CIS, you must comply with the following requirements :

1. Identify Subcontractor’s Employment Status

The initial step for a contractor upon hiring a worker for a construction project is to confirm their employment status.

Confirmation is necessary as the deduction and reporting requirements under CIS only apply to self-employed subcontractors.

Whereas, if the construction workers are hired as employees, the monthly payroll must be run, and tax & NIC must be deducted through the Pay as You Earn (PAYE) system.

The above verification is not required for limited company subcontractors.

You can take guidance from HMRC if you need help determining whether your subcontractor is self-employed or employed.

2. Verify Subcontractor’s Registration Status

Prior to issuing the first payment, contractors are required to verify their subcontractors with HMRC.

The verification allows the contractor to know the rate at which the CIS is to be deducted. Based on the verification status, the deduction rate may vary from 0%, 20%, and 30% for every subcontractor.

Information required for Subcontractor’s Verification

Sole-Trader

- Name

- Unique Taxpayer Reference (UTR)

- National Insurance Number (NINO)

Partnerships

- Firm’s name

- Firm’s UTR

- Partner’s name & UTR

Limited Company

- Name

- Unique Taxpayer Reference (UTR)

- Company Registration Number

By using your business’s Government Gateway user ID and password, you can sign into the Construction Industry Scheme (CIS) online to verify your subcontractor.

Additional Subcontractor Verification

Further to the initial verification, the contractor should perform additional verification of their subcontractor’s status with HMRC.

This is required :

- If the contractor has not paid the subcontractor in the last two years, or

- The subcontractor has not been included in any prior CIS returns.

For Example,

A contractor re-engages one of the prior subcontractor ‘B’ in January 2023. The last time the contractor paid subcontractor was October 2018,(4 years ago).

Here, the contractor re-engages with subcontractor ‘B‘ who has not been included in any of their previous two year’s CIS returns. This exclusion means the contractor must re-verify the subcontractor before making any payments.

3. Deduct Construction Industry Scheme Tax

The contractors must withhold the CIS amount, every time they make a payment to their subcontractors.

CIS must be deducted only on the Gross Invoice Amount,

That Includes:

- Labour cost

- Travel or subsistence expense

That Excludes:

- Cost of materials

- Value Added Tax (VAT)

- Retention by Contractor

For Example,

ABC Ltd. is contractor who has recently received an invoice from its subcontractor. The invoice depicts the cost of material to be £530, a labour charge of £200 and travel and accommodation cost of £80.

The subcontractor is registered for VAT and CIS at the standard rate. The prevailing contract between them allows the contractor to retain 5% of the contract value.

Calculation for CIS Tax Deduction

|

Particulars |

Amount |

|---|---|

|

Labour cost |

£200 |

|

Material cost |

£530 |

|

Travel & accommodation costs |

£80 |

|

Gross amount |

£810 |

|

Less: 5% retention |

(£40) |

|

Less: CIS deduction (20%) |

(£53) |

|

Net payment to Subcontractor |

£717 |

Calculate your CIS tax deductions with help of UKPA CIS Calculator.

Payment Retention by Contractor’s obligations

Contractors often retain a certain percentage of the subcontractor’s payment as security in the event that the subcontractor fails to meet the agreed quality of work.

Moreover, when such retentions are returned to subcontractors, the CIS deduction is made in a usual way like other payments.

For Example,

SDJ Ltd. is a contractor who hired VIP Construction Ltd. to build a commercial building at £465,000 contract price within 8 months timeframe.

Contract terms allow the contractor to withhold a 5% retention of the contract price.

Step 1. Initial Payment

Initially, SDJ Ltd. paid 40% of the contract amount i.e., £182,400 as advance. So, it retains £9,120 and then calculates CIS on a net amount of £173,280.

VIP Construction Ltd is registered as payment under deduction, thus receiving £138,624 after CIS deduction of £34,656 (20%* £138,624).

Step 2. Retention payment

After the contract terminates SDJ Ltd. fully refunded the retention amount to VIP Construction Ltd. i.e., £23,250 (5%* £465,000).

Before the payment, SDJ Ltd verified VIP Construction Ltd. with HMRC and confirmed it was still registered to pay under deduction.

Hence, in the event of retention payment SDJ Ltd. needs to deduct CIS of £4,650 (20%* £23,250).

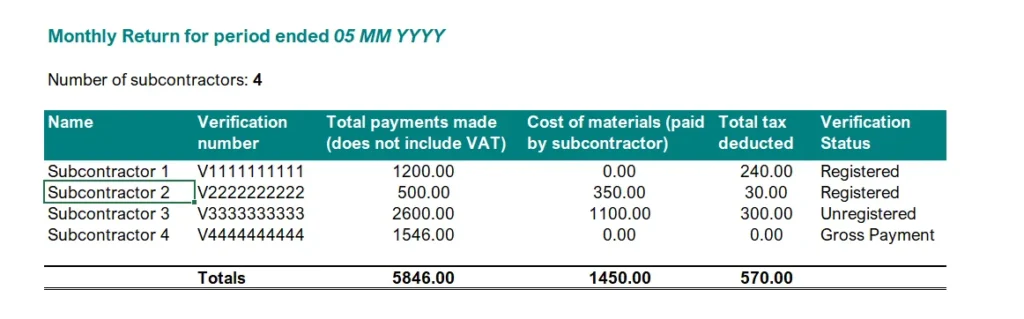

4. Submit Monthly CIS Return

Every month, a contractor must send CIS Return notifying HMRC about the payments made to all subcontractors.

The return must reach HMRC no later than the 19th of every month.

For Example,

The CIS Return of month of March should be submitted by 19th of April.

Sample of CIS-300 Return :

Nil CIS Returns

If the contractor has not paid any subcontractors during a month, it still needs to send a Nil CIS return to HMRC.

5. Pass CIS Tax Deductions to HMRC

Contractors are liable to pass all CIS tax deductions made from subcontractors’ payments to HMRC.

The payment can be made either electronically or through the cash, cheques being deposited at post office.

- Online: 22nd of the end of tax month

- Cash or Cheques at Post: 19th of the end of tax month.

For Example,

The CIS Payment of month of March should be sent to HMRC by 22nd of April if it is paid through an electronic medium.

Quarterly CIS Payment

Contractors have the option of paying HMRC the CIS deductions quarterly if their average monthly payments of PAYE, NIC, and CIS deductions total is below £1,500.

However, it is crucial to remember that the contractor is still required to submit monthly CIS returns to HMRC, even if they opt for quarterly payments. The quarterly payment options are limited to the quarter ending January, April, July and October.

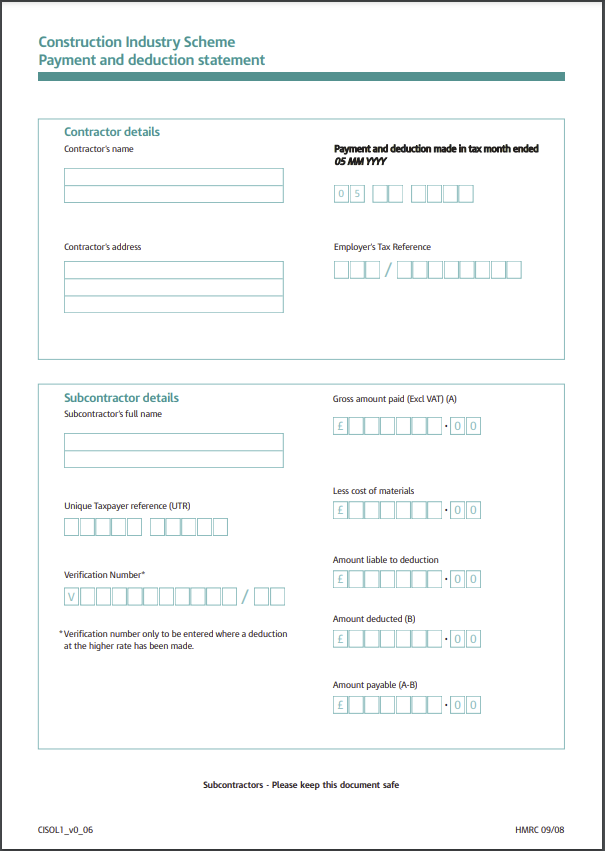

6. Supply PDS to Subcontractors and Maintain Records

Each subcontractor has the right to receive payment and deduction statements (PDS) from its contractor as proof of CIS deduction.

In addition, the contractor must keep accurate records of their subcontractors’ details, records of CIS deductions, payments, and returns for at least three years.

Sample of PDS :

This record-keeping is essential not only for compliance purposes, but it also serves as a safeguard in case of HMRC review at any time.

Conclusion

The Construction Industry Scheme (CIS) places certain responsibilities on contractors. If we analyse further, contractors face greater compliance obligations under the Construction Industry Scheme than subcontractors do.

As a result, the contractor’s general obligations stands a better chance of being penalized if any non-compliance is discovered. Whether it is failing to submit CIS returns, failing to pass CIS deductions on time, or failing to keep proper records.

Frequently asked Questions

What is the deadline for CIS return submission?

You must submit your monthly CIS Return within 14 days of the end the of tax month. For example, the CIS return for February must be submitted by the 19th of March.

What is the deadline for CIS payments?

You must pass the CIS deductions from the subcontractors to HMRC within 17 days of the end of the tax month. For example, the CIS deductions for February must be passed to HMRC by the 22nd of March.

Do I need to file a CIS return even if there is no payment to subcontractors during a month?

Yes, you need to file the nil CIS return for the month when no payments are made to subcontractors.

When does a tax month end?

A tax month ends on the 5th of the subsequent month. This indicates that the month of January ends on the 31st of January. However, for tax purposes, January is considered to have ended on the 5th of February.