Embarking on the journey of self-employment comes with responsibilities, and one crucial aspect is registering for Self-Assessment. This article provides a step-by-step guide to make the process easy, free, and secure.

Understanding Self Employed & Self-Assessment

Before diving into the registration process, it’s essential to grasp the concept of Self-Assessment. When you’re self-employed, you may have a team working with you, but the ultimate responsibility for the business and any associated losses rests on your shoulders.

Whether you sell goods, offer services, freelance, work as a contractor, service consultant, seasonal worker, coach, content creator, or any other role, the key point is that if your earnings exceed £1,000 and are not taxed at the source, you are required to register for Self-Assessment and fulfil the obligation of completing a tax return.

If you choose to, you have the option to register as self-employed even if your income is £1,000 or less. In such cases, you can either opt to pay voluntary Class 2 National Insurance or record any incurred losses.

Getting Started Online

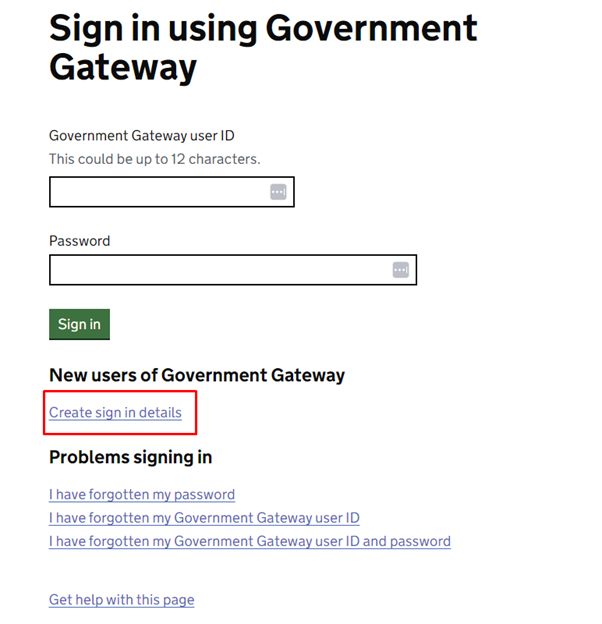

To utilise HMRC online services, a Government Gateway account is required. If you don’t have one, creating your sign-in details is a straightforward process.

Step 1: Creating Sign in Details

Click on the link to create Sign in Details: Sign in to your HMRC business tax account

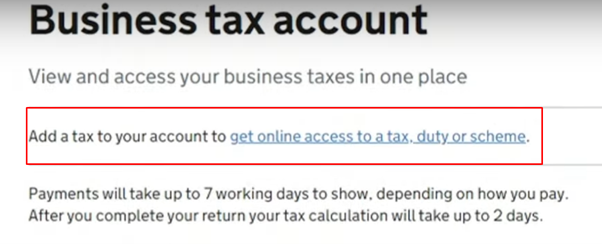

Step 2: Business Tax Account Sign in

Once signed in using your Business Tax Account, select ‘get online access to a tax duty or scheme’.

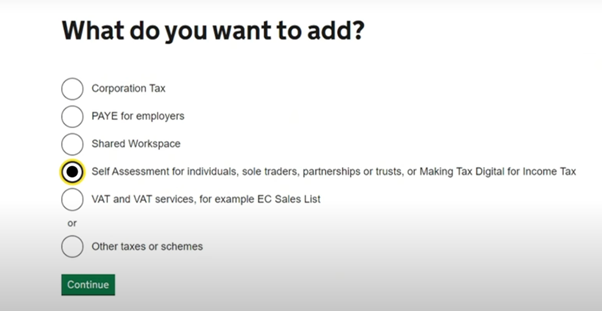

Step 3 : Choosing the Self-Assessment Option

Choose the Self-Assessment option.

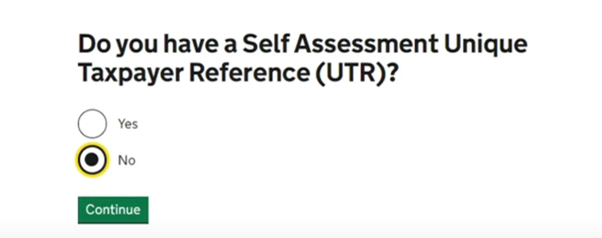

If you’re registering for the first time, indicate ‘No’ when asked about a Unique Taxpayer Reference (UTR).

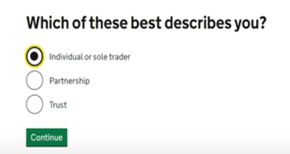

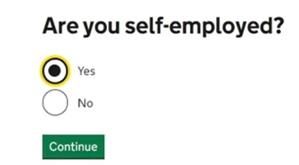

Describe yourself as an ‘Individual or sole trader’ and confirm your self-employed status.

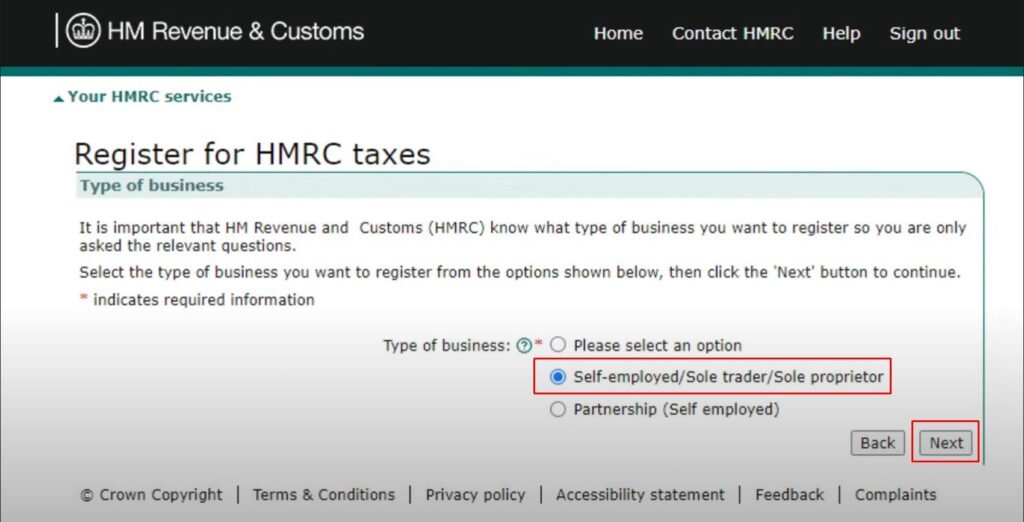

Then check the Self-Assessment Box and choose next. Click on Self-employed/Sole Trader/Sole Proprietor.

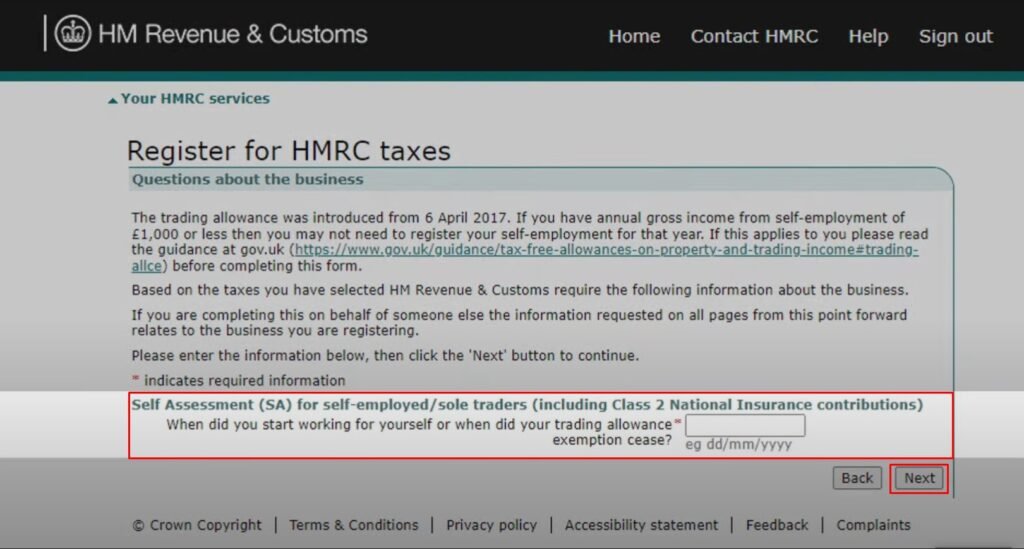

Step 4: Enter the Date you become Self-employed

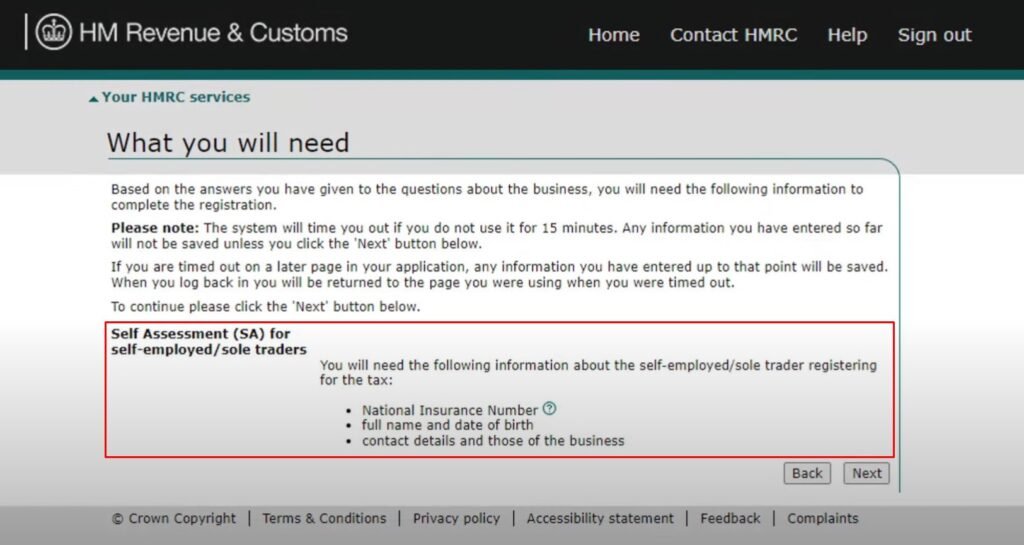

We need to enter the date you become self-employed. You need the following information as well:

- National Insurance Number

- Full name and date of birth

- Contact Details

Step 5: Fill Personal Information and Business Details for Registration

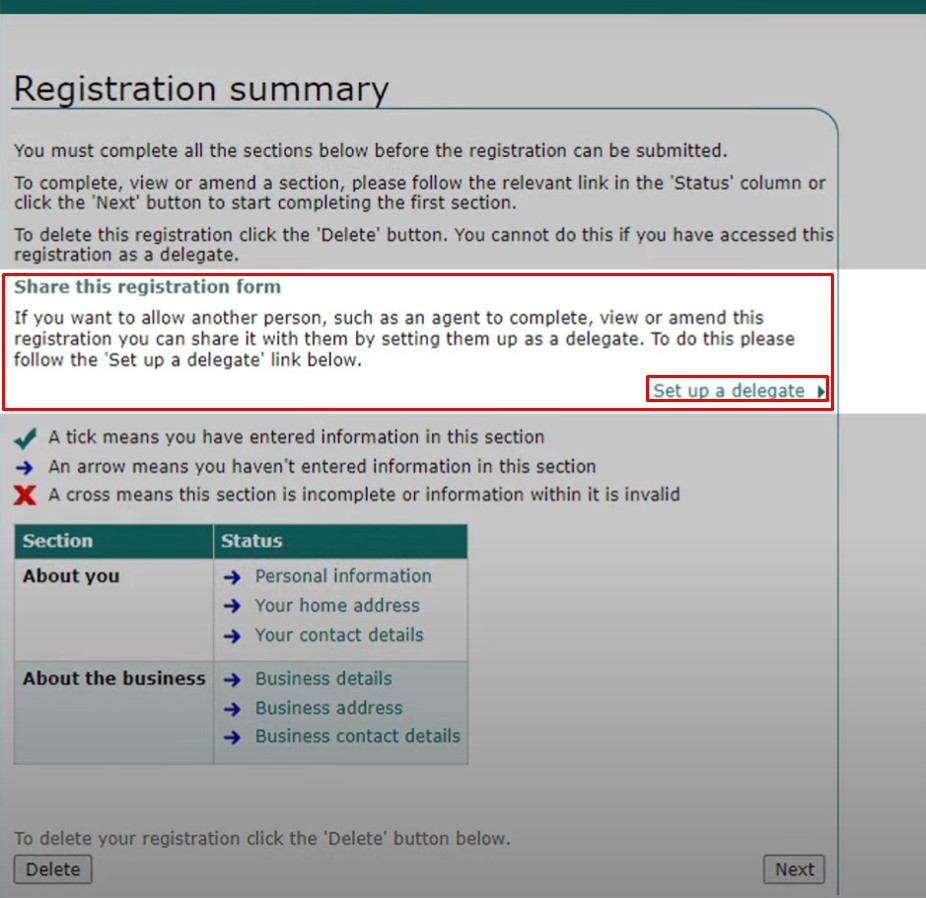

You can complete the registration yourselves or else someone on your behalf can complete your registration. Usually, a bookkeeper, accountant or tax agent will help you on this.

Following information is required for the registration:

- You need to provide the personal information, your home address and your contact details.

- Further you need to provide the business details, its address and business contact details.

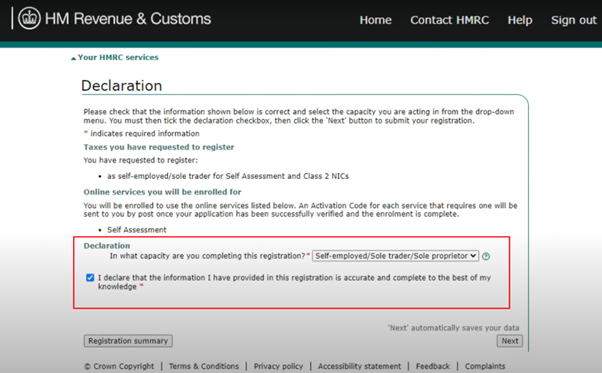

Step 6: Finalising Registration

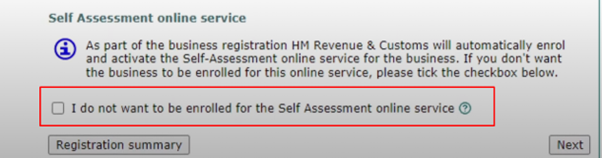

Review and ensure all sections are filled out, leaving the last box unticked for a simplified activation of the Self-Assessment online service.

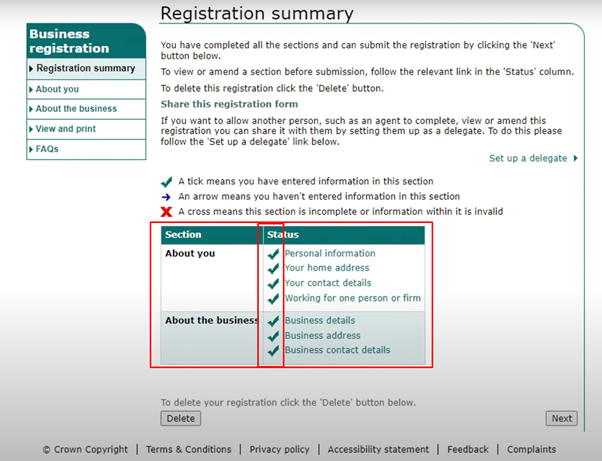

Once you fill every section, the status will appear as ticked.

Confirm the accuracy of your details and submit your registration.

Unlock the process: Learn ” how to register for Self Assessment if you’re not self-employed “. Dive into our article for deep insights.

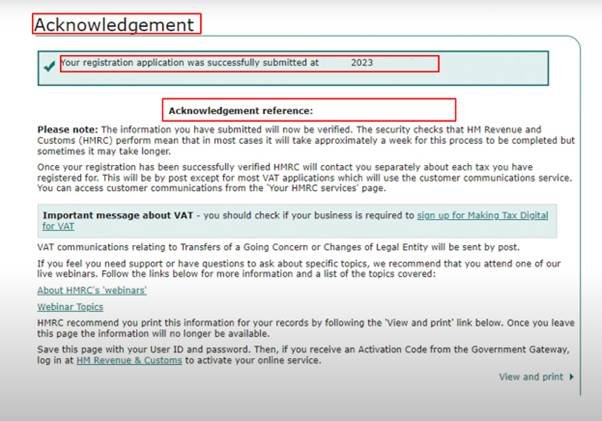

Step 7: Confirmation

Upon completion, a confirmation page acknowledges your successful registration. HMRC will perform verification checks on the background.

Explore our comprehensive guide to “Self-Assessment Tax for UK landlords” Dive in for invaluable insights and answers to your FAQs.

Unique Taxpayer Reference Number

In 15 days (or 21 days for those residing abroad), you will be mailed a Unique Taxpayer Reference (UTR). For quicker access, you can retrieve it by logging into your online account or using the HMRC app.

Treat your UTR with care, as it is comparable to your National Insurance Contribution (NIC) number and will be a lifelong identifier essential for all future interactions related to your Self-Assessment.

Important Dates:

Register by 5 October in the tax year following your self-employment start. Submit your tax return and pay any owed tax by 31 January, or earlier if possible.

For additional information, refer tour complete guide on Self-Assessment Tax Return. Registering for Self-Assessment is a crucial step toward fulfilling your tax obligations as a self-employed individual.

We are dedicated to solve your queries.

Contact us for assistance at any stage of your journey.