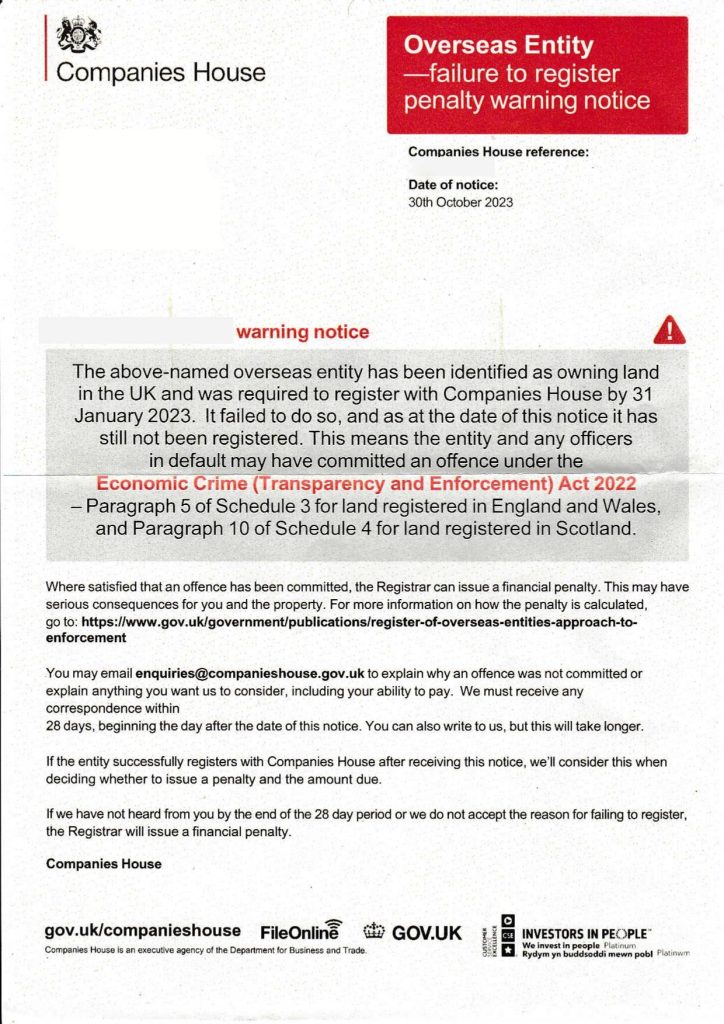

Companies House has issued a compelling notice directed at Overseas Entities that were mandated to complete registration by the deadline of January 31, 2023, but have yet to fulfil this requirement.

The failure to register within the stipulated timeframe is considered a violation of the Economic Crime (Transparency and Enforcement) Act 2022, with distinct provisions outlined in Paragraph 5 of Schedule 3 for land registered in England and Wales and Paragraph 10 of Schedule 4 for land registered in Scotland.

Entities and the respective officers who find themselves recipients of this notice and harbour doubts about having committed an offence are afforded the opportunity to seek clarification.

This can be achieved by reaching out to Companies House through the designated email address, enquiries@companieshouse.gov.uk, within a 28-day window from the date of receiving the notice.

It’s important to note that entities registering with Companies House subsequent to the notice will be taken into account, potentially resulting in a more lenient penalty assessment.

However, a notable consequence awaits those who neglect to respond within the specified 28-day timeframe. In such cases, severe penalties will be imposed without the provision for presenting reasons. The Registrar will proceed to issue a financial penalty, emphasising the urgency and gravity of complying with registration requirements.

This proactive initiative by Companies House underscores the vital role of transparency and compliance in the contemporary business landscape. For Overseas Entities, adherence to regulatory requirements is not only a legal obligation but a strategic imperative for maintaining a robust legal standing. Moreover, timely compliance ensures the avoidance of penalties that could have detrimental effects on the normal course of operations.

In navigating the intricate regulatory landscape, it is incumbent upon entities to stay abreast of updates and promptly address compliance obligations. Proactive engagement with regulatory bodies and a commitment to meeting obligations are pivotal aspects of responsible corporate governance in jurisdictions subject to such regulatory frameworks.