The UK tax system is designed to ensure that individuals and businesses pay their fair share of Income Tax. In most cases, tax is automatically deducted from wages and pensions, making the process seamless for many taxpayers.

However, there are instances where individuals and businesses must report their income and expenses themselves through a system known as Self-Assessment.

This guide will explore the critical aspects of Self-Assessment tax returns in the UK.

What is Self-Assessment Tax Return?

Self-assessment is a system HM Revenue and Customs (HMRC) uses to collect Income Tax from those whose taxes are not automatically deducted from wages or pensions (known as PAYE). A self-assessment tax return is a form that individuals in the UK must submit to HMRC each year if they owe tax on income received.

Who needs to file for a Self-Assessment Tax Return?

If you fall into any of these categories, you’ll need to file a self-assessment tax returns:

- Self-employed individuals paying income tax and National Insurance on their profits.

- Those earning £100,000 or more in the last tax year as employees or pensioners.

- Individuals earning £10,000 or more from savings interest or investment income.

- If you earned £2,500 or more in untaxed income, e.g. tips or commission.

- People eligible for tax relief on pension contributions as higher or additional rate taxpayers.

- Those owing capital gains tax from selling profitable assets.

- Claimants of child benefit when their or their partner’s income exceeds £50,000.

- Individuals with taxable income from abroad or receiving UK income while living abroad.

- People receiving state pensions surpassing their personal allowances and having no other income sources.

- Business partners or directors of limited companies.

- Trustees of registered pension schemes or other trusts.

- Trustees or representatives of deceased individuals.

- Members (“names”) at the Lloyd’s of London insurance market.

- Ministers of religion.

- Recipients of a P800 form from HMRC indicating unpaid tax and outstanding balances.

Additionally, you may need to send a tax return if you have untaxed income, such as COVID-19 grants or support payments, rental income, tips, commission, savings and investment income, dividends, or foreign income.

How to Register for Self-Assessment?

If you’re submitting a tax return for the first time, follow these steps:

- Register with HMRC online, choosing the appropriate category (self-employed, a partner or business partnership, landlord, a company director, etc.).

- Obtain your Unique Taxpayer Reference (UTR) number, sent to you after registration.

- Activate your Government Gateway account using the provided activation code, which will be sent by post.

- Complete your account setup, which allows you to log in and file your tax return.

It is worth remembering that this process can take up to 20 working days, so don’t leave it until the last minute.

You need to supply the below information to register with HMRC:

- Name

- Address

- Previous address (if you’ve lived in your current address for less than 3 years)

- National Insurance number

- Date of birth

- Phone number

- Email address

- Date you started as self-employed.

- Nature of your business

- Business address

- Business telephone number

How to Fill in a Self-Assessment Tax Return?

Self-assessment tax returns can be filed online or through the paper form.

- For online tax returns, complete the sections relevant to your situation.

- Use the SA100 form and any supplementary pages applicable to your circumstances for paper tax returns.

- Some people may receive a simplified SA200 return, decided by HMRC.

You’ll need to include details such as income, state pensions, private pensions, benefits, and other income. Be prepared with your records, including National Insurance and UTR numbers, income documentation, and any other relevant paperwork.

Explore the intricacies of “Stamp Duty Land Tax” – your guide to smarter property investments starts here. Explore Now.

What are the Key Deadlines for Self Assessment Tax Return?

Meeting the various deadlines is crucial to avoid penalties. Here are some key dates to remember:

Deadline for Informing HMRC

If you need to complete a tax return and have not done so before, inform HMRC by 5 October. For example, you started your self-employment on 1 June 2022, you have got until 5 October 2023 to register.

Paper Return Submission

If you submit a paper tax return, the deadline is midnight on 31 October.

Online Return Submission

For online tax returns, the deadline is midnight on 31 January.

Tax Payment Deadline

You must pay the tax you owe by midnight on 31 January. If you make advance payments, known as ‘payments on account,’ there is typically a second payment deadline of 31 July. Late payments may incur penalties, but you can appeal if you have a valid reason for the delay.

You can pay via,

- Through your online bank account

- Using online or telephone banking (Faster Payments)

- By CHAPS

- By debit or corporate credit card online

- At your bank or building society

- Bacs

- Direct Debit

- Cheque through the post

Deadline for Tax Year 2022-23

|

Self-Assessment Key Dates |

|

|---|---|

|

Tax Year 2022-23 |

Deadline |

|

Registration for Self-Assessment |

By 05 October 2023 |

|

Submission of Paper Tax Return |

By 31 October 2023 |

|

Submission of Online Tax Return |

By 31 January 2024 |

|

Tax Payment |

By 31 January 2024 |

|

Amend Tax Return |

By 31 January 2025 |

Ready to master the ins and outs of UK Income Tax? Dive into our “Income Tax in UK – A Complete Guide” and get the knowledge you need.

Can I Amend My Return if I do not know My Actual Profit?

In cases where you do not know your profit for the entire tax year, you should provide provisional figures when submitting your return.

Once you determine the actual profit, you have up to 12 months from the Self-Assessment deadline to adjust and file an amended tax return.

What Information is Required to Complete Your Tax Return?

Filing your tax return is a crucial annual task for individuals and businesses in the United Kingdom.

To ensure accuracy and compliance with tax regulations, you must provide specific information about your financial activities for the tax year.

Income and Gains

Your tax return should encompass all taxable income and gains for the relevant tax year. Here are the primary elements you may need to include:

Self-Employment Income and Expenses

Details of your self-employment income and expenses are essential. These will help you calculate your trading profit or loss for the year. Invoices, receipts and bank statements are required.

Property Income and Expenses

If you earn income from renting out property, you must provide information about your property income and expenses. This will enable you to determine your rental profit or loss for the year.

If you earn income from property, it’s crucial to maintain the following records:

- Invoices for the work you have undertaken.

- Receipts for expenses you’ve paid.

- Bank statements.

- Statements from letting agents or details of Rental Income if you don’t use an agent.

- Information showcasing how you accounted for any private use of items in your business (e.g., mileage logs for vehicles used for business and personal purposes).

Employment and Pensions Income

Gather information about your employment and pension income, including forms like P60, P11D, and P45 from any jobs you held during the tax year

Interest Income

Ensure you have interest certificates from banks or building societies to account for the interest income you received.

Pension Contributions

Record details of any Pension Contributions made to relief at source schemes.

Capital Gains

If you made any chargeable capital gains during the tax year, you should provide information about them.

Maintaining Records

Keeping accurate records is a fundamental aspect of completing your tax return effectively. While you don’t need to send original documents to HMRC (Her Majesty’s Revenue and Customs), it’s wise to maintain these records as backup and to demonstrate that you took reasonable care when preparing your tax return.

How long shall we retain the records for?

The duration for which you should retain records depends on your financial circumstances:

- Self-Employed or Property Income: You must keep records supporting your tax return for five years after the standard 31 January deadline.

- Not Self-Employed and No Property Income: If you file your tax return on time, you are required to maintain records for 12 months after the same deadline. If you file late, the record-keeping period extends to 15 months.

Note: While you can maintain records in physical (paper) form, it is worth noting that HMRC is planning to introduce a digital record-keeping system for aspects such as trading and property income.

This means that you may be required to keep digital records in the future. Therefore, it’s advisable to start thinking about this transition now to ensure you’re well-prepared when the new system is implemented.

Ready to master property tax strategies? Dive into the full guide “A Complete Property Tax Guide for Landlords and Property Investors” and empower your investments with knowledge.

How do I register & send the return?

If you are required to send a tax return and have not done so before, you must register for Self-Assessment. To register, you can follow HMRC’s guidelines.

If you are new to Self-Assessment, keeping detailed records and considering seeking assistance with filling in your return is essential.

What are the situations where I am no longer required to send a tax return?

If you believe you no longer need to send a tax return, you must inform HMRC. Once HMRC agrees with your assessment, they will send a letter confirming that you are exempt from filing a return. Failing to do so before the Self-Assessment deadline of 31 January may result in penalties.

Reasons for no longer needing to send a return could include:

- No longer being self-employed,

- No longer renting out property,

- No longer being subject to the High-Income Child Benefit Charge or

- Having an income below the £100,000 threshold.

Learn everything you need to know about “Inheritance Tax in the UK“. Get started on managing your estate with our comprehensive guide.

What are the Penalties for Late Filing?

Failing to meet the filing and payment deadlines can lead to penalties.

Late Filing Penalties

|

Period of delay |

Penalty |

|---|---|

|

One day |

£100 automatic fixed penalty applies |

|

3 months |

£10 for each following day – 90-day maximum – £900 |

|

6 months |

Higher of – £300 or 5% of the tax due |

|

12 months |

Higher of £300 or 5% of the tax due |

- An immediate penalty of £100 is imposed for late submission.

- An additional daily charge of £10 is levied if the return is delayed for three months, with a maximum duration of 90 days.

- A penalty equivalent to the higher of £300 or 5% of the tax owed is applied if the return is delayed for six months.

- A further penalty, amounting to the higher of £300 or 5% of the tax owed, is imposed if the return is delayed for 12 months.

Interest is charged on late payments. You can appeal against a penalty if you have a reasonable excuse.

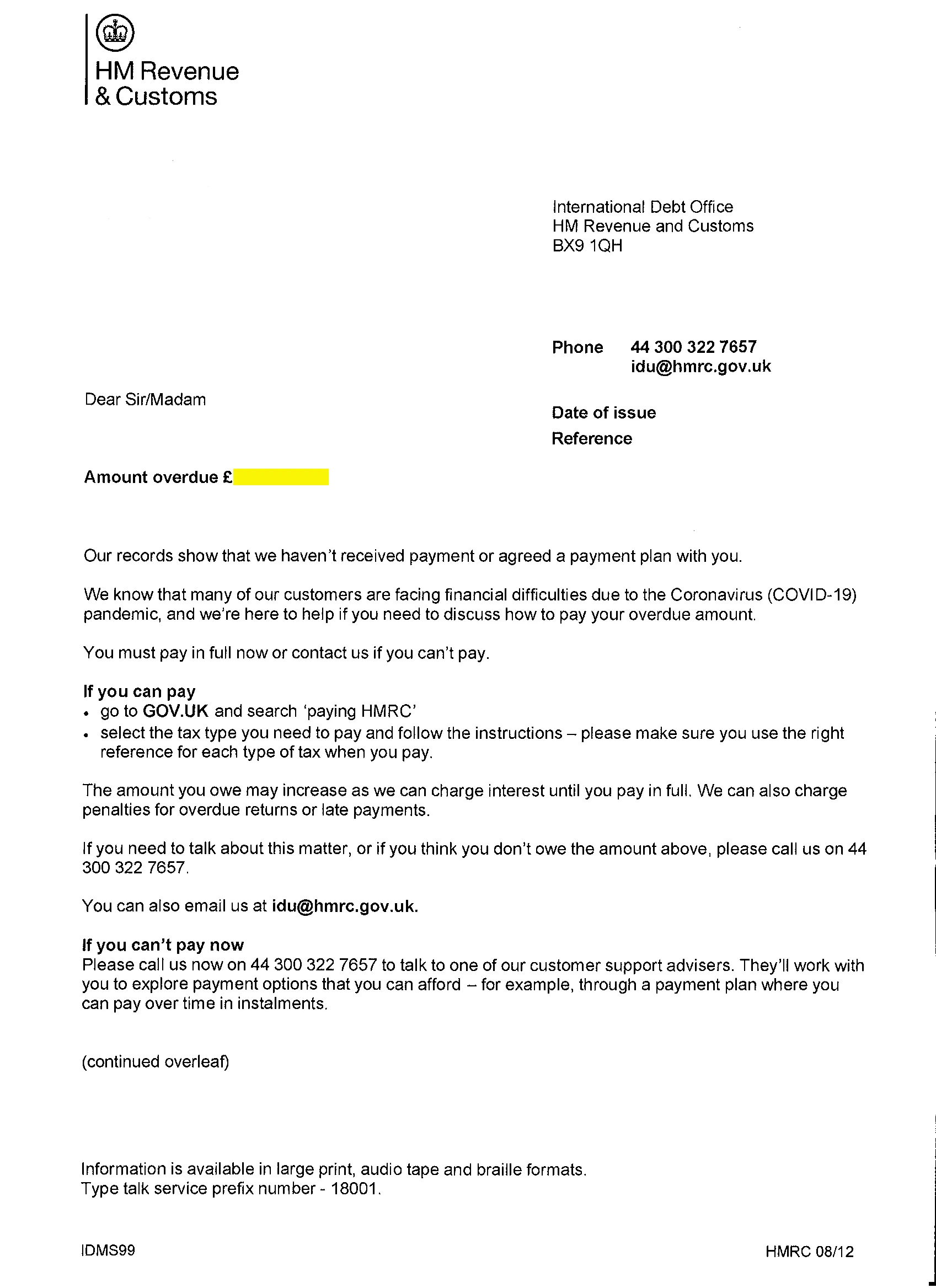

If you haven’t filed your self-assessment tax return, you may receive a Self Assessment Penalty letter similar to the one shown below.

Sample- Self Assessment Penalty Letter

HMRC often sends Self Assessment penalty letter, even if you are not required to file Self Assessment Tax Return. If received one, we can help you!

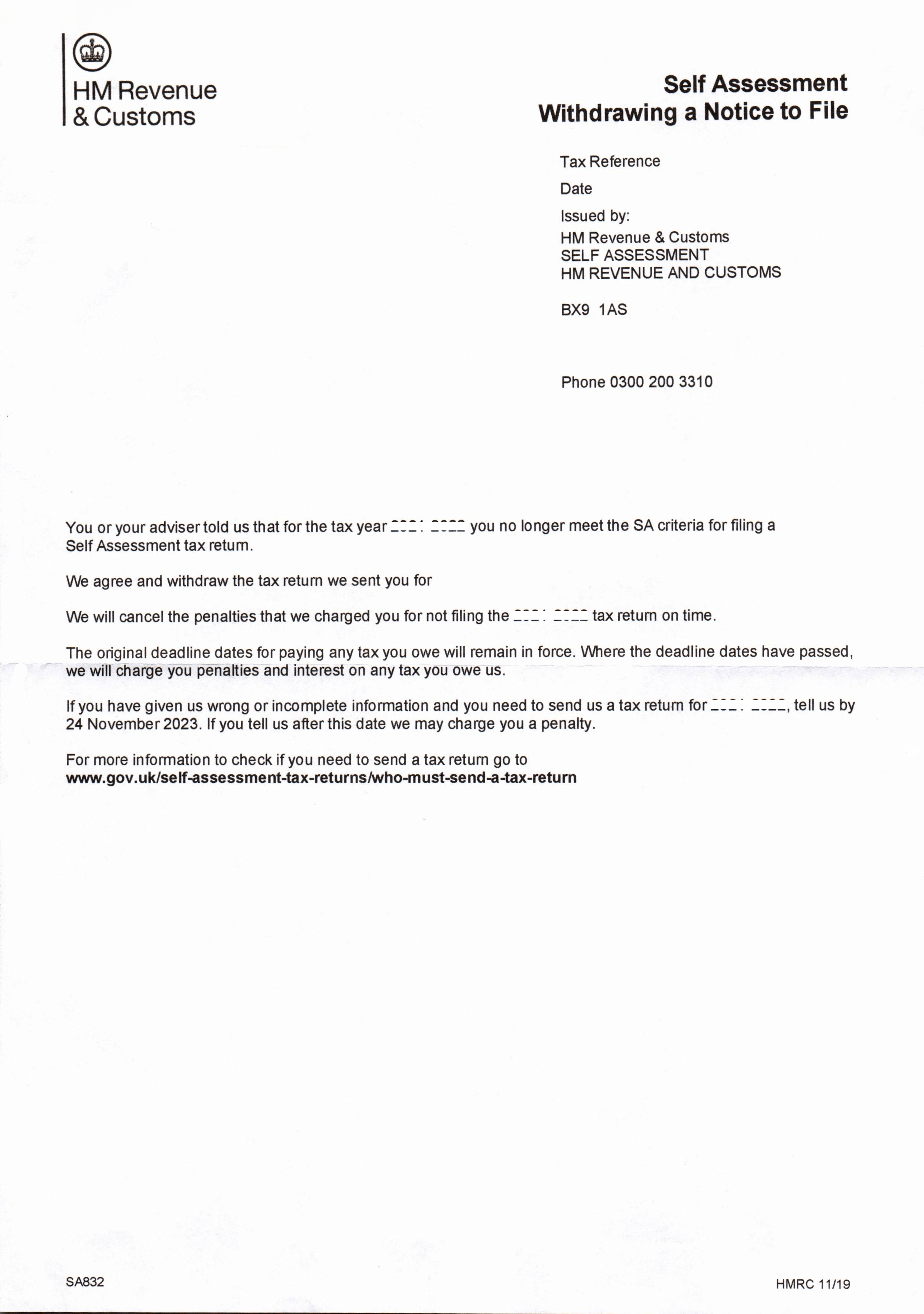

Sample- Self Assessment Penalty Waived off for one of our client

Explore Our Self Assessment Tax Return Services!

What are the Penalties for Late Payment of Tax?

Failure to pay the self-assessment tax by 31 January would result in the below penalties along with the interest.

Late payment of tax

|

Period of delay |

Penalties |

|---|---|

|

30 days |

5% of the unpaid tax |

|

6 months |

5% of the unpaid tax (additional) |

|

12 months |

5% of the unpaid tax (additional) |

- A 30-day delay results in a 5% penalty of the unpaid tax.

- A 6-month delay incurs an additional 5% penalty of the unpaid tax.

- A 12-month delay also results in an additional 5% penalty of the unpaid tax.

For example,

In the tax year 2022-23 (from 6 April 2022 to 5 April 2023), if you submitted your self-assessment tax return online and had a tax liability of £15,000, the payment deadline would be 31 January 2024.

However, if you made the payment on 30 March 2024, exceeding the 30-day grace period, you would incur a late payment penalty of £750 (which is 5% of the £15,000 owed).

What are the penalties for mistakes when filing a Self-Assessment Tax Return?

HMRC has the authority to impose penalties if errors are found in your tax return; however, the severity of the penalty and whether one will be levied is contingent upon the specific nature of the mistake:

|

Type of Behaviour |

Unprompted Disclosure |

Prompted Disclosure |

|---|---|---|

|

Non-deliberate-within 12 months of tax being due |

0% to 30% |

10% to 30% |

|

Non-deliberate-12 months or more after tax was due |

10% to 30% |

20% to 30% |

|

Deliberate |

20% to 70% |

35% to 70% |

|

Deliberate and concealed |

30% to 100% |

50% to 100% |

Ready to master UK Payroll Taxes? Dive into our Complete Guide on “UK Payroll Taxes and Deductions for Employers“. Read now for expert insights.

What is the procedure for changing the tax return?

You may need to change your tax return, such as correcting mistakes or reporting foreign income. The process for updating your return differs depending on whether you filed it online or on paper.

You must wait three days (72 hours) after filing to make changes online before updating your return. You can access your tax return within your HMRC online account, make the necessary corrections, and resubmit it.

For paper returns, you should contact HMRC to make the required amendments and send the corrected pages to the address provided. Ensure you clearly label the pages as “amendment” and include your name and Unique Taxpayer Reference (UTR).

If you need to make changes or corrections beyond the specified deadlines or for tax returns from earlier years, you should write to HMRC.

How to file returns for someone who has died?

If you are required to complete a Self-Assessment tax return for someone who has passed away, you must follow specific procedures. You will need details about the deceased person’s financial affairs, including bank accounts, savings, employment or pension income, and any other sources of income.

It is essential to inform HMRC about the death using the Tell Us Once service as soon as possible. You can then post the completed tax return, adhering to the deadline provided in the letter you received from HMRC.

If you are handling the deceased’s estate, you may also need to register with HMRC and submit a separate tax return on behalf of the estate.

What are the key points to consider for a Self-Assessment Tax Return?

If you fall into the above category, it is essential to understand the following key points:

- Reporting Period: You should fill in your Self-Assessment tax return after the end of the tax year, which runs from 6 April to 5 April the following year.

- Obligation: You must send a tax return if HMRC specifically asks you to do so. Failure to comply with this request may result in interest and penalties.

- Filing Options: You can submit your tax return online or request a paper form.

- Return filing Deadlines: It is crucial to meet the filing deadlines to avoid fines. If you are required to complete a tax return and have not done so before, you must inform HMRC by 5 October. The final deadline for submitting your tax return in paper form is 31 October & online is 31 January.

- Record Keeping: Maintaining accurate records, such as bank statements and receipts, is essential to fill in your tax return correctly.

- Payment Deadline: HMRC will calculate the amount you owe based on your report. Ensure that you pay your Self-Assessment bill by 31 January.

- Income Tax Bands: The amount of tax you pay depends on your Income Tax band. Different rates apply to other types of tax, such as Capital Gains Tax (CGT).

Conclusion

In summary, this comprehensive guide aims to help individuals and businesses steer the complexities of the UK Self-Assessment tax return system, ensuring compliance with tax regulations and avoiding penalties while accurately reporting their financial activities.