Businesses are legally bound to submit the taxable benefit information to HMRC. The cash benefits are generally sent through payroll as part of payroll cycle whereas the non-cash benefit is submitted through P11D Forms.

P11D is used to report the taxable benefits provided by employers in form of non-cash benefit.

Understanding P11D Form

P11D is a form that employers use to annually report the cash equivalents of benefits and expenses provided to their employees or director. In another word, P11D Form is designed to collect information of any benefits in kind not covered by their salary.

A P11D Form requires employer name and PAYE reference plus employee’s basic identification details like Name, Date of Birth, Gender, and National Insurance Number. Rest part of the form covers other benefits detail being given to employees on top of their normal pay.

When an employer provides certain benefits such as:

- A company Car/fuel

- Private medical insurance

- Interest free loans

- Accommodation

- Meal Vouchers

- Child Care costs

- Gym memberships to their employees

- Non-business travel and entertainment expenses

they are required to report the cash value of those benefits on a P11D Form. It is the sole responsibility of the employer to submit this form to HM Revenue and Custom (HMRC) on behalf of their employees.

What is P11D(b) Form?

Similarly, P11D (b) Form is send to HMRC with the details of amount showing additional tax or Class 1A National Insurance due to expenses and benefits provided to employees.

P11D(b) lets you know what to report and when to report it, a list of employees who may require P11D, Class 1A National Insurance Contribution due. For HMRC, it’s the declaration that you have submitted all the information regarding the expenses and benefit, and that you have not knowingly left any details.

As per the requirement of HMRC, Employer must keep the records of the following details in relation to P11Ds that you have not knowingly left any details.

- The details and the date of every expense or benefit you provide

- The details of any payments your employee contributes to an expense or benefits

- Any other information needed to work out the amounts you put in P11Ds

Exemptions in P11D and P11D(b) Forms

You don’t need to report certain expenses and benefits in the P11Ds Form if you qualify for an exemption. Following are some examples:

To qualify for the exemption, you have to meet either of the following two conditions:

- Paying back the employee’s actual costs (no profit made by employees on the costs)

- Paying a flat rate approved by HMRC to the employees (e.g., 45p per mile up to 10,000 miles for business travel via employee car)

If your business provides your employees taxable benefits or expenses, you will need to submit the P11Ds Forms with the details of the benefits or expenses and Class 1A NIC details.

Your business will pay Class 1A NIC at 13.8% on the taxable benefits or expenses you declare in P11Ds.

- Business travel

- Phone Bills

- Business entertainment expenses

- Uniforms and tools for work

Calculation of Benefits in Kind

Employers provide employees with various benefits in kind.

Common benefits in kind would include cars & car fuel, van & van fuel, living accommodation, mileage allowance payments, interest free loans, private medical treatment & insurance, relocation expenses etc. which we will discuss in detail as under:

1. Cars and Car Fuel

We specialise in preparing accurate and well-organised financial records for serviced accommodation owners.

Our experienced accountants work closely with property owners to gather all relevant financial information, including rental income, expenses, and other transactions. We compile and analyse this data to create comprehensive accounts that adhere to accounting standards and regulations.

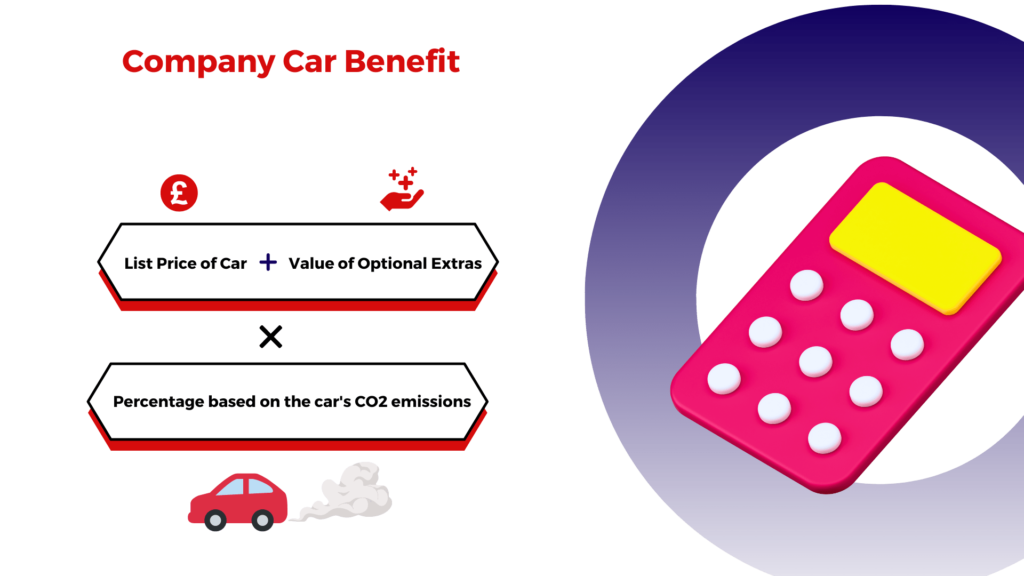

Employers providing their employees with the car and fuel benefits for private use represents taxable benefits. Normally, company car benefit can be calculated as:

[List price of car + value of any optional extras] x percentage based on the car’s CO2 emissions.

In case, if the car had no list price when it registered, then notional price should be used.

In simple term, List price is made up of Basic price plus VAT and any delivery charges.

For example,

Suppose Car A is priced at £20,000 on the road which includes £19,000 list price (basic plus VAT), £600 for delivery, £400 for excise duty & first registration fee. In this case, allowable list price would be £19,600.

In P11D, employer should use key letter to indicate the type of fuel or power used in each car.

- F: Diesel cars which meet Euro 6d standard

- D: Diesel cars

- A: All other cars

Similarly, the appropriate percentage for cars first registered before 1 January 1998 and cars registered after that date with no approved CO2 emissions figure is based on the car’s engine size as follows:

|

Engine Size |

Registered Before 1 January 1998 |

Registered After 1997 with no approved CO2 figure |

|---|---|---|

|

0 to 1400c |

24% |

24% |

|

1401cc to 2000cc |

35% |

35% |

|

Over 2000cc |

37% |

37% |

|

Rotary Engine Cars |

37% |

37% |

To keep in mind, there will be no benefit charge if:

- Fuel was provided solely for business travel purposes.

- If an allowance was paid which covered fuel cost for private travel

2. Van and Van Fuel

The van benefit and van fuel benefit charged for the tax year 2022/23 is £3,600 and £688 respectively.

However, the charged might be reduced for the periods when a van was unavailable. Similarly, you need to report the zero-emission van on the P11D at 0% of £3,600 which is £0.

You don’t have to report for van and van fuel benefits if:

- It is used for business journey or as a pool van.

- It is a part of a salary sacrifice.

- A business journey is a trip made as part of work or to a temporary workplace.

3. Living Accommodation

Employer must enter cash equivalent of the living accommodation provided to the employee, director, their family, or household by the reason of employment.

To calculate the cash equivalent, use gross value before community charge for the rating, if it is owned and use the amount of rent payable (including any lease premium amount) if the accommodation is rented.

In addition to accommodation, if an employer has made payment for the employees bills such as electricity and other benefits like furniture, then it should be shown in ‘other item’ section of P11D.

4. Mileage Allowance Payments

Mileage allowance payments (MAP) are related to expenses paid to the employees for the use of own vehicles during the business travel.

If they carry other employees during the business travel then payment must be made specifically, this is commonly known as Passenger payments. Cars or vans (including those powered by electricity), Motorcycles and cycles are three kinds of vehicles under MAPs.

Employer should enter the approved amount for each payment which is exempt from tax. The approved amount for MAPs is calculated as :

(Business miles travelled * the appropriate rates for the kind of vehicles used)

Appropriate rates for different vehicles under MAPs are determined on the basis of miles travelled. Details are mentioned in below table:

|

No. of Business Miles | ||

|---|---|---|

|

Vehicle Type |

First 10,000 Miles |

Above 10,000 Miles |

|

Cars and Vans |

45p |

25p |

|

1401cc to 2000cc |

24p |

24p |

|

Over 2000cc |

20p |

20p |

5. Interest-Free and Low Interest and National Loans

When an employee or director receives cheap or interest-free loan by a reason of employment then it comes under benefits in kind. Employee is taxable on the difference between interest at official rate and the interest actually paid, such loan is known as beneficial loans.

They are also benefited if loan made by reason of their employment is released or written off. Employee or director is no longer obliged to repay but tax charge will arise irrespective of the terms.

Employer should enter the details of loan made to director or employee on which:

- Amount of actual interest paid was less than interest paid at the official rate

- No interest was paid.

Employer should disregard loan, if you know the total amount outstanding on all loans, or all non-qualifying loans are £10,000 or less in 2022 to 2023, when completing section ‘Interest-free and low interest loans’ of P11D.

Private Medical Treatment or Insurance

It includes all the medical & dental expenses and insurance premium paid against treatment of an employee by the employers.

These expenses should be mentioned in the ‘payments made on behalf of employee’ section of P11D.

Qualifying Relocation Expense Payments and Benefits

Expenses and Benefits are qualified if they are exempt and meet the other qualifying conditions.

Employer should enter excess over £8,000 of the total amount of all qualifying. This £8,000 limit applies to the whole relocation not just the item such as qualifying expenses and benefits provided during the year. Enter non-qualifying relocation cost in ‘other item’ and ‘Expenses payment made on behalf of the employee’ section of P11D.

1. Disposal expenses & benefits

- Legal fees or services connected to disposal

- Advertising

- Disconnection of electricity, gas, water, or phone services, etc

Note: Council Tax for the period is not allowable

2. Acquisition Expenses and Benefits

- Legal expenses and services connected with the acquisition

- Land registry fees in England & Wales

- Stamp Duty

- Connection of electricity, gas, water, and phone services

3. Transport of Belongings

This covers physical removal of domestic belongings from the old residence to the new and costs of insuring them in transit.

- Packing and Unpacking

- Temporary Storage if a direct move from is not made

4.

Travel and Subsistence

- Preliminary visit to the new location

- Travelling between the old home and new work location and vice versa

- Temporary living accommodation

- travelling between the old home and the temporary living accommodation and vice-versa

5.

Domestic Good for the New Residence

The relief applies where domestic goods intended to replace items used at the old home which are not suitable for use in the new home are bought or provided by the employer.

6.

Bridging Loan

- Bridging loan interest is reimbursed to the employee

- The employer makes cheap or interest-free loan to the employee

Calculation of Employer National Insurance

Employer’s National Insurance is calculated on the cash equivalents of non-cash benefits that are provided to employees.

For example,

If a company has provided car benefits to three employees during the tax year 2022/23. Total of Cash equivalent for all three car equals to £12,000.00, then employer is required to pay Class 1A NIC to HMRC which is £1,656.00 (i.e., 13.8% of £12,000.

How to File P11D and P11D(b)

Employer has option to submit P11D and P11D (b) through :

- HMRC’s PAYE online service

- Commercial Software

The only way to file P11D form is online as paper submission are no longer accepted for tax year 2022/23 and beyond.

Form shall be submitted to HM Revenue and Customs (HMRC) through PAYE online for employer’s portal or by using a Payroll Software. Filing a P11D form can be time consuming if you have many employees to file for.

Timeline to File P11D Form

The P11D form should be submitted by the employer to HM Revenue and Customs (HMRC) on an annual basis, specifically by July 6th following the end of the tax year, which runs from April 6th to April 5th. Any Class 1A National Insurance you then owe must be paid a couple of weeks later by the 22nd of July.

Additionally, the employer must also provide a copy of the P11D form to each employee concerned. It’s important for employers to accurately complete the P11D form, including all relevant details of the benefits and expenses provided, as any errors or omissions may result in penalties from HMRC.

Penalties for Late Filing P11D Form

The deadline for filing the P11D Form is 6th July following the end of the tax year.

However, no penalties would be levied till 19th July following the end of the tax year. There would be penalty of £100 per 50 employees for each month or part month after July 19th.

Significance of P11D Submission:

Submission of P11D allows the tax authorities, HM Revenue and Customs (HMRC), to assess whether any additional tax from employee or National Insurance contributions from the employer is due on non-payroll benefits.

Moreover, it ensures that correct amount of tax is deposited by both the employer and the employee as per PAYE Regulations.

Mandating P11D form is a measure adopted by HM Revenue and Customs (HMRC) to prevent tax evasion and incorrect reporting. It is collection of employees data that can be further used for understanding employees benefits and expenses trend. The findings of statistical analysis and research report based on the information collected in form P11D can be essential in making policy decisions and tax regulations.

Furthermore, employee’s financial information is maintained more transparently as accountability of employee’s benefit is measured and recorded accurately. It provides better reference for audit purpose as well.